ComEd 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

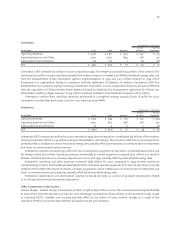

Quantitative and Qualitative Disclosures About Market Risk

Exelon is exposed to market risks associated with commodity price, credit, interest rates and equity prices. The inherent risk in

market sensitive instruments and positions is the potential loss arising from adverse changes in commodity prices, counterparty

credit,interest rates and equity security prices. Exelon’s corporate Risk Management Committee (RMC) sets forth risk management

philosophy and objectives through a corporate policy, and establishes procedures for risk assessment, control and valuation,

counterparty credit approval, and the monitoring and reporting of derivative activity and risk exposures. The RMC is chaired by

Exelon’s chief risk officer and includes the chief financial officer,general counsel, treasurer,vice president of corporate planning and

officers from each of the business units. The RMC reports to the board of directors on the scope of Exelon’s derivative activities.

Commodity Price Risk

Commodity price risk is associated with market price movements resulting from excess or insufficient generation, changes in

fuel costs, market liquidity and basis. Trading activities and non-trading marketing activities include the purchase and sale of

electric capacity and energy and fossil fuels, including oil, gas and coal. The availability and prices of energy and energy-related

commodities are subject to fluctuations due to factors such as weather, environmental policies, changes in supply and

demand, state and federal regulatory policies and other events.

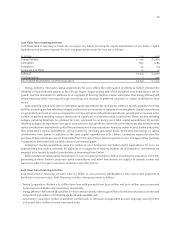

Marketing (non-trading) activities To the extent Exelon’s generation supply, (either owned or contracted) is in excess of its

obligations to customers, including ComEd and PECO’s retail load, that available electricity is sold into the wholesale markets.

To r educe price risk caused by market fluctuations, Exelon enters into derivative contracts, including forwards, futures, swaps,

and options with approved counterparties to hedge Exelon’s anticipated exposures. Market price risk exposure is the risk of a

change in the value of unhedged positions. Exelon expects to maintain a minimum 80% hedge ratio in 2002 for its energy

marketing portfolio.This hedge ratio represents the percentage of Exelon’s forecasted aggregate annual generation supply that

is committed to firm sales, including sales to Energy Delivery’s retail load. The hedge ratio is not fixed and will vary from time

to time depending upon market conditions, demand and volatility. Absent any opportunistic efforts to mitigate market price

exposure, the estimated market price exposure for the non-trading portfolio associated with a ten percent reduction in the

average around-the-clock market price of electricity is an approximate $100 million decrease in net income, or approximately

$0.30 per share. This sensitivity, which is consistent with prior guidance, assumes an 80% hedge ratio, and that price changes

occur evenly throughout the year and across all markets. The sensitivity also assumes a static portfolio. Exelon expects to

actively manage its portfolio to mitigate the market price exposure. Actual results could differ depending on the specific

timing of, and markets affected by, the price changes, as well as future changes in Exelon’s portfolio.

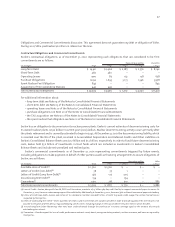

Trading activities Exelon began to use financial contracts for trading purposes in the second quarter of 2001. The trading

activities were entered into as a complement to Exelon’s energy marketing portfolio and represent a very limited portion of

Exelon’s overall energy marketing activities. For example, the limit on open positions in electricity for any forward month

represents less than 5% of the owned and contracted supply of electricity.The trading portfolio is planned to grow modestly in

2002, subject to stringent risk management limits and policies, including volume, stop-loss and value-at-risk limits to manage

exposure to market risk. A value-at-risk (VAR) model is used to assess the market risk associated with financial derivative

instruments entered into for trading purposes. VAR represents the potential gains or losses for instruments or portfolios due

to changes in market factors, for a specified time period and confidence level.The measured VAR as of December 31, 2001, using

a Monte Carlo model with a 95% confidence level and assuming a one-day time horizon was approximately $800,000. The

measured VAR represents an estimate of the potential change in value of Exelon’s portfolio of trading related financial

derivative instruments. These estimates, however, are not necessarily indicative of actual results, which may differ due to the

fact that actual market rate fluctuations may differ from forecasted fluctuations and due to the fact that the portfolio may

change over the holding period.