ComEd 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

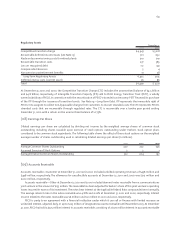

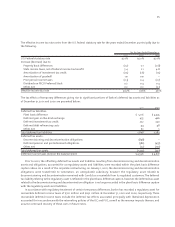

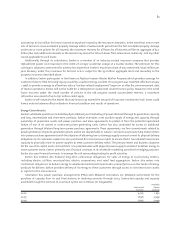

Company Obligated Mandatorily Redeemable Preferred Securities

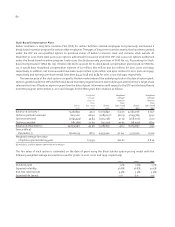

At December 31, 2001 and 2000, subsidiary trusts of PECO and ComEd had outstanding the following preferred securities:

Mandatory Distri- Liqui- at December 31,

Redemption bution dation 2001 2000 2001 2000

Date Rate Value Trust Securities Outstanding Dollar Amount

PECO Energy

Capital Trust II 2037 8.00% $ 25 2,000,000 2,000,000 $ 50 $ 50

PECO Energy

Capital Trust III 2028 7.38% 1,000 78,105 78,105 78 78

Total 2,078,105 2,078,105 $ 128 $ 128

ComEd Financing I 2035 8.48% $ 25 8,000,000 8,000,000 $200 200

ComEd Financing II 2027 8.50% 1,000 150,000 150,000 150 150

Unamortized Discount (21) (22)

Total 8,150,000 8,150,000 $ 329 $ 328

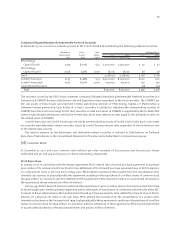

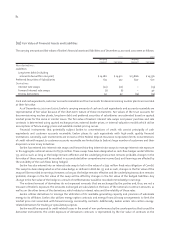

The securities issued by the PECO trusts represent Company Obligated Mandatorily Redeemable Preferred Securities of a

Partnership (COMRPS) having a distribution rate and liquidation value equivalent to the trust securities. The COMRPS are

the sole assets of these trusts and represent limited partnership interests of PECO Energy Capital, L.P. (Partnership), a

Delaware limited partnership. Each holder of a trust’s securities is entitled to withdraw the corresponding number of

COMRPS from the trust in exchange for the trust securities so held. Each series of COMRPS is supported by PECO’s deferrable

interest subordinated debentures, held by the Partnership, which bear interest at rates equal to the distribution rates on

the related series of COMRPS.

ComEd Financing I and ComEd Financing II are wholly owned subsidiary trusts of ComEd. Each ComEd trust’s sole assets

are subordinated deferrable interest securities issued by ComEd bearing interest rates equivalent to the distribution rate

of the related trust security.

The interest expense on the debentures and deferrable interest securities is included in Distributions on Preferred

Securities of Subsidiaries in the Consolidated Statements of Income and is deductible for income tax purposes.

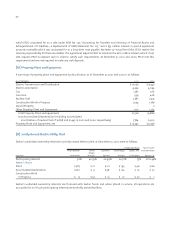

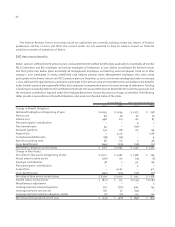

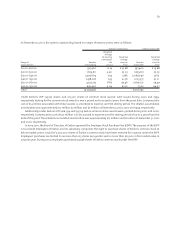

(18) Common Stock

At December 31, 2001 and 2000, common stock without par value consisted of 600,000,000 and 600,000,000 shares

authorized and 321,006,904 and 319,005,112 shares outstanding, respectively.

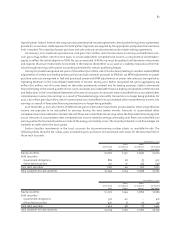

Stock Repurchase

In January 2000, in connection with the Merger Agreement, PECO entered into a forward purchase agreement to purchase

$500 million of its common stock from time to time. Settlement of this forward purchase agreement was, at PECO’s election,

on a physical, net share or net cash basis. In May 2000, PECO utilized a portion of the proceeds from the securitization of its

stranded cost recovery to physically settle this agreement, resulting in the repurchase of 12 million shares of common stock

for $496 million. In connection with the settlement of this agreement, PECO received $1 million in accumulated dividends on

the repurchased shares and paid $6 million of interest.

During 1997, PECO’s Board of Directors authorized the repurchase of up to 25 million shares of its common stock from time

to time through open-market, privately negotiated and/or other types of transactions in conformity with the rules of the SEC.

Pursuant to these authorizations, PECO entered into forward purchase agreements to be settled from time to time, at PECO’s

election, on a physical, net share or net cash basis. PECO utilized the proceeds from the securitization of a portion of its

stranded cost recovery in the first quarter of 1999, to physically settle these agreements, resulting in the purchase of 21 million

shares of common stock for $696 million. In connection with the settlement of these agreements, PECO received $18 million

in accumulated dividends on the repurchased shares and paid $6 million of interest.