ComEd 2001 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

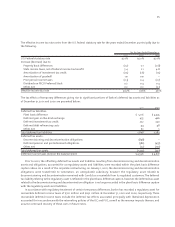

85

assessed up to $121 million for losses incurred at any plant insured by the insurance companies. In the event that one or more

acts of terrorism cause accidental property damage within a twelve month period from the first accidental property damage

under one or more policies for all insureds, the maximum recovery for all losses by all insureds will be an aggregate of $3.2

billion plus such additional amounts as the insurer may recover for all such losses from reinsurance, indemnity , and any other

source, applicable to such losses.

Additionally, through its subsidiaries, Exelon is a member of an industry mutual insurance company that provides

replacement power cost insurance in the event of a major accidental outage at a nuclear station. The premium for this

coverage is subject to assessment for adverse loss experience. Exelon’s maximum share of any assessment is $46 million per

year. Recovery under this insurance for terrorist acts is subject to the $3.2 billion aggregate limit and secondary to the

property insurance described above.

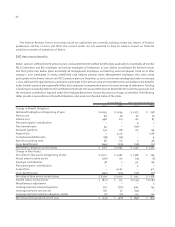

In addition, Exelon participates in the American Nuclear Insurers Master Worker Program, which provides coverage for

worker tort claims filed for bodily injury caused by a nuclear energy accident. This program was modified, effective January

1, 1998, to provide coverage to all workers whose “nuclear-related employment” began on or after the commencement date

of reactor operations. Exelon will not be liable for a retrospective assessment under this new policy. However, in the event

losses incurred under the small number of policies in the old program exceed accumulated reserves, a maximum

retroactive assessment of up to $50 million could apply.

Exelon is self-insured to the extent that any losses may exceed the amount of insurance maintained. Such losses could

have a material adverse effect on Exelon’s financial condition and results of operations.

Energy Commitments

Exelon’s wholesale operations include the physical delivery and marketing of power obtained through its generation capacity,

and long, intermediate and short-term contracts. Exelon maintains a net positive supply of energy and capacity, through

ownership of generation assets and power purchase and lease agreements, to protect it from the potential operational

failure of one of its owned or contracted power generating units. Exelon has also contracted for access to additional

generation through bilateral long-term power purchase agreements. These agreements are firm commitments related to

power generation of specific generation plants and/or are dispatchable in nature—similar to asset ownership. Exelon enters

into power purchase agreements with the objective of obtaining low-cost energy supply sources to meet its physical delivery

obligations to its customers. Exelon has also purchased firm transmission rights to ensure that it has reliable transmission

capacity to physically move its power supplies to meet customer delivery needs. The primary intent and business objective

for the use of its capital assets and contracts is to provide Exelon with physical power supply to enable it to deliver energy to

meet customer needs. Exelon primarily uses financial contracts in its wholesale marketing activities for hedging purposes.

Exelon also uses financial contracts to manage the risk surrounding trading for profit activities.

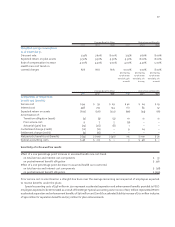

Exelon has entered into bilateral long-term contractual obligations for sales of energy to load-serving entities,

including electric utilities, municipalities, electric cooperatives, and retail load aggregators. Exelon also enters into

contractual obligations to deliver energy to wholesale market participants who primarily focus on the resale of energy

products for delivery. Exelon provides delivery of its energy to these customers through access to its transmission assets

or rights for firm transmission.

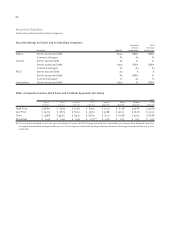

Generation has power purchase arrangements (PPAs) with Midwest Generation, LLC (Midwest Generation) for the

purchase of capacity from its coal fired stations, in declining amounts through 2004. Contracted capacity and capacity

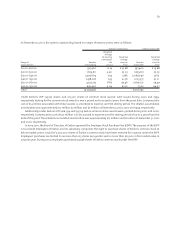

available through the exercise of an annual option are as follows (in megawatts):

Available

Contracted Option

Capacity Capacity

2002 4,013 1,632

2003 1,696 3,949

2004 1,696 3,949