ComEd 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

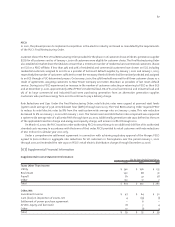

Capitalized Interest

Exelon uses SFAS No. 34, “Capitalizing Interest Costs,” to calculate the costs during construction of debt funds used to

finance its non-regulated construction projects. Exelon recorded capitalized interest of $17 million, $2 million and $6 million

in 2001, 2000 and 1999, respectively.

Allowance for Funds Used During Construction (AFUDC) is the cost, during the period of construction, of debt and equity

funds used to finance construction projects for regulated operations. AFUDC is recorded as a charge to Construction Work

in Progress and as a non-cash credit to AFUDC which is included in Other Income and Deductions. The rates used for

capitalizing AFUDC are computed under a method prescribed by regulatory authorities.

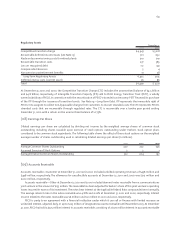

Income Taxes

Deferred Federal and state income taxes are provided on all significant temporary differences between book bases and tax

bases of assets and liabilities. Investment tax credits previously utilized for income tax purposes have been deferred on the

Consolidated Balance Sheets and are recognized in book income over the life of the related property. Exelon and its

subsidiaries file a consolidated Federal income tax return. Income taxes are allocated to each of Exelon’s subsidiaries within

the consolidated group based on the separate return method.

Gains and Losses on Reacquired Debt

Recoverable gains and losses on reacquired debt related to regulated operations are deferred and amortized to interest

expense over the period consistent with rate recovery for ratemaking purposes. Gains and losses on other debt are

recognized in Exelon’s Consolidated Statements of Income as incurred.

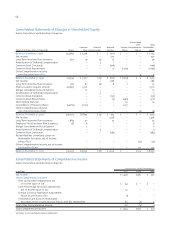

Comprehensive Income

Comprehensive income includes all changes in equity during a period except those resulting from investments by and

distributions to shareholders. Comprehensive income is reflected in the Consolidated Statements of Changes in Shareholders’

Equity and the Consolidated Statements of Comprehensive Income.

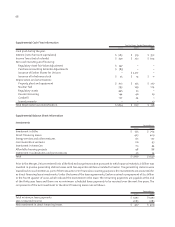

Cash and Cash Equivalents

Exelon considers all temporary cash investments purchased with an original maturity of three months or less to be

cash equivalents.

Restricted Cash

Restricted cash reflects unused cash proceeds from the issuance of the transitional bonds and transitional trust notes, and

escrowed cash to be applied to the principal and interest payment on the transitional bonds and transitional trust notes.

Marketable Securities

Marketable securities are classified as available-for-sale securities and are reported at fair value, with the unrealized gains

and losses, net of tax, reported in other comprehensive income. Under regulatory accounting practices, unrealized gains

and losses on marketable securities held in the nuclear decommissioning trust funds are reported in accumulated

depreciation for operating units and as a reduction of regulatory assets for retired units. When regulatory accounting

practices are discontinued, unrealized gains and losses on marketable securities held in the nuclear decommissioning trust

funds are reported in accumulated other comprehensive income. At December 31, 2001 and 2000, Exelon had no held-to-

maturity or trading securities.