ComEd 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

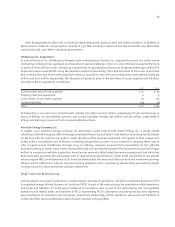

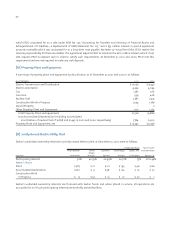

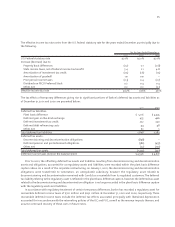

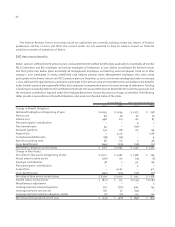

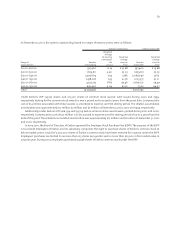

The effective income tax rate varies from the U.S. Federal statutory rate for the years ended December 31 principally due to

the following:

For the Years Ended December 31,

2001 2000 1999

U.S. Federal statutory rate 35.0% 35.0% 35.0%

Increase (decrease) due to:

Property basis differences (0.2) 0.1 (0.8)

State income taxes, net of Federal income tax benefit 3.4 2.1 4.8

Amortization of investment tax credit (0.5) (1.6) (1.5)

Amortization of goodwill 1.9 0.9 –

Prior period income taxes (0.3) 0.4 (0.7)

Dividends on PECO Preferred Stock 0.2 0.4 0.4

Other, net 0.2 0.3 (0.1)

Effective income tax rate 39.7% 37.6% 37.1%

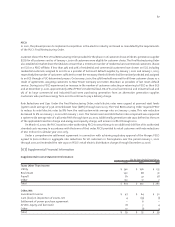

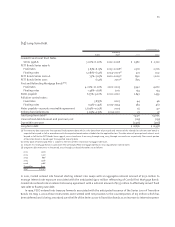

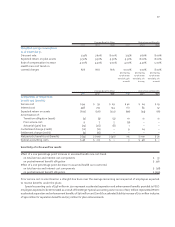

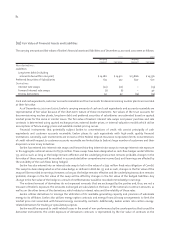

The tax effects of temporary differences giving rise to significant portions of Exelon’s deferred tax assets and liabilities as

of December 31, 2001 and 2000 are presented below:

2001 2000

Deferred tax liabilities:

Plant basis difference $ 5,116 $ 4,535

Deferred gain on like-kind exchange 453 466

Deferred investment tax credit 222 330

Deferred debt refinancing costs 44 48

Other, net 63 5

Total deferred tax liabilities 5,898 5,384

Deferred tax assets:

Decommissioning and decontamination obligations (898) –

Deferred pension and postretirement obligations (382) (437)

Other, net (22) (270)

Total deferred tax assets (1,302) (707)

Deferred income taxes (net) on the balance sheet $ 4,596 $ 4,677

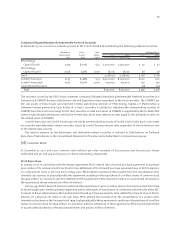

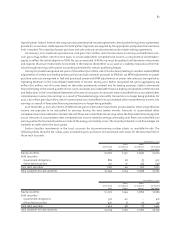

Prior to 2001, the offsetting deferred tax assets and liabilities resulting from decommissioning and decontamination

assets and obligations, accounted for as regulatory assets and liabilities, were recorded within the plant basis difference

caption above. As a result of the corporate restructuring, on January 1, 2001, the decommissioning and decontamination

obligations were transferred to Generation, an unregulated subsidiary; however the regulatory asset related to

decommissioning and decontamination remained with ComEd as a receivable from its regulated customers. The deferred

tax liability relating to the regulatory asset is reflected in the plant basis difference caption, however, the deferred tax asset

related to the decommissioning and decontamination obligation is no longer recorded in the plant basis difference caption

with the regulatory assets and liabilities.

In accordance with regulatory treatment of certain temporary differences, Exelon has recorded a regulatory asset for

recoverable deferred income taxes of $701 million and $632 million at December 31, 2001 and 2000, respectively. These

recoverable deferred income taxes include the deferred tax effects associated principally with liberalized depreciation

accounted for in accordance with the ratemaking policies of the ICC and PUC, as well as the revenue impacts thereon, and

assume continued recovery of these costs in future rates.