ComEd 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

– Revenue taxes. The change in revenue taxes represents a change in presentation of certain revenue taxes from operating

revenue and tax expense to collections recorded as liabilities resulting from Illinois legislation. This change in presentation

does not affect income.

– Other Effects. A strong housing construction market in Chicago has contributed to residential and small commercial and

industrial customer volume growth, partially offset by the unfavorable impact of a slower economy on large commercial and

industrial customers.

The reduction in Wholesale and Miscellaneous revenues in 2001, as compared to 2000, reflects lower off-system sales

due to the expiration of wholesale contracts that were offered by ComEd from June 2000 to May 2001 to support the open

access program in Illinois, partially offset by increased transmission service revenue and the reversal of a $15 million reserve

for revenue refunds to ComEd’s municipal customers as a result of a favorable Federal Energy Regulatory Commission

(FERC) ruling.

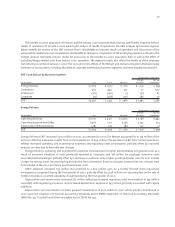

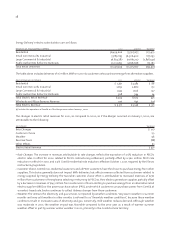

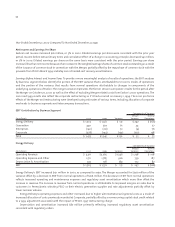

Energy Delivery’s gas sales statistics are as follows:

2001 2000 Variance

Deliveries in million cubic feet (mmcf) 81,528 91,686 (10,158)

Revenue (in millions) $ 654 $ 532 $ 122

The changes in gas revenue for 2001, as compared to 2000, are as follows:

(in millions) Variance

Price $174

Weather (38)

Volume (14)

Gas Revenue $122

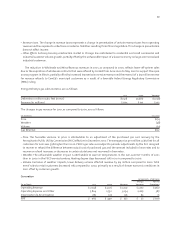

– Price. The favorable variance in price is attributable to an adjustment of the purchased gas cost recovery by the

Pennsylvania Public Utility Commission (PUC) effective in December 2000. The average price per million cubic feet for all

customers for 2001 was 39% higher than 2000. PECO’s gas rates are subject to periodic adjustments by the PUC designed

to recover or refund the difference between actual cost of purchased gas and the amount included in base rates and to

recover or refund increases or decreases in certain state taxes not recovered in base rates.

– Weather. The unfavorable weather impact is attributable to warmer temperatures in the non-summer months of 2001

than in 2000 in the PECO service territory. Heating degree days decreased 12% in 2001 compared to 2000.

– Volume. Exclusive of weather impacts, lower delivery volume affected revenue by $14 million compared to 2000. Total

mmcf sales to retail customers decreased 11% compared to 2000, primarily as a result of slower economic conditions in

2001 offset by customer growth.

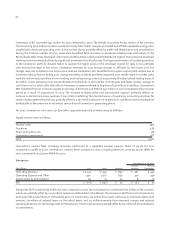

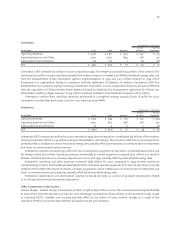

Generation

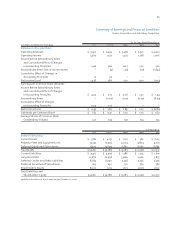

Components of Variance

Merger Normal

(in millions) 2001 2000 Variance Variance Operations

Operating Revenue $ 7,048 $ 3,316 $ 3,732 $ 2,772 $ 960

Operating Expense and Other 5,804 2,750 3,054 2,667 387

Depreciation & Amortization 282 126 156 83 73

EBIT $ 962 $ 440 $ 522 $ 22 $ 500