ComEd 2001 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

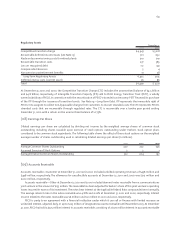

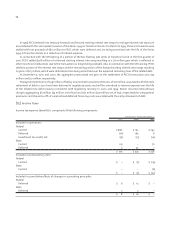

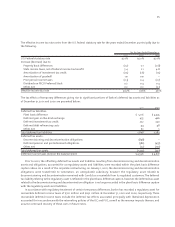

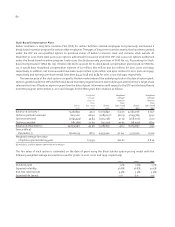

Exelon provides certain health care and life insurance benefits for retired employees. In 2001, Exelon adopted an

amendment to the former Unicom postretirement medical benefit plan that changed the eligibility requirement of the plan

to cover only employees who retire with 10 years of service after age 45 rather than with 10 years of service and having

attained the age of 55. Welfare benefits for active employees are provided by several insurance policies or self-funded plans

whose premiums or contributions are based upon the benefits paid during the year.

Additionally, Exelon sponsors nonqualified supplemental retirement plans which cover any excess pension benefits that

would be payable to management employees under the qualified plan but which are limited by the Internal Revenue Code.The

fair value of plan assets excludes $58 million held in trust as of December 31, 2001 for the payment of benefits under the

supplemental plan and $8 million held in trust as of December 31, 2001 for the payment of postretirement medical benefits.

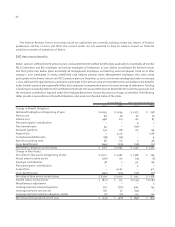

Exelon sponsors savings plans for the majority of its employees.The plans allow employees to contribute a portion of their

pretax income in accordance with specified guidelines. Exelon matches a percentage of the employee contribution up to

certain limits. The cost of Exelon’s matching contribution to the savings plans totaled $57 million, $17 million and $7 million

in 2001, 2000 and 1999, respectively.

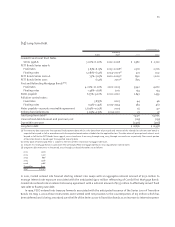

(17) Preferred Securities of Subsidiaries

Preferred and Preference Stock

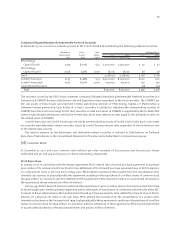

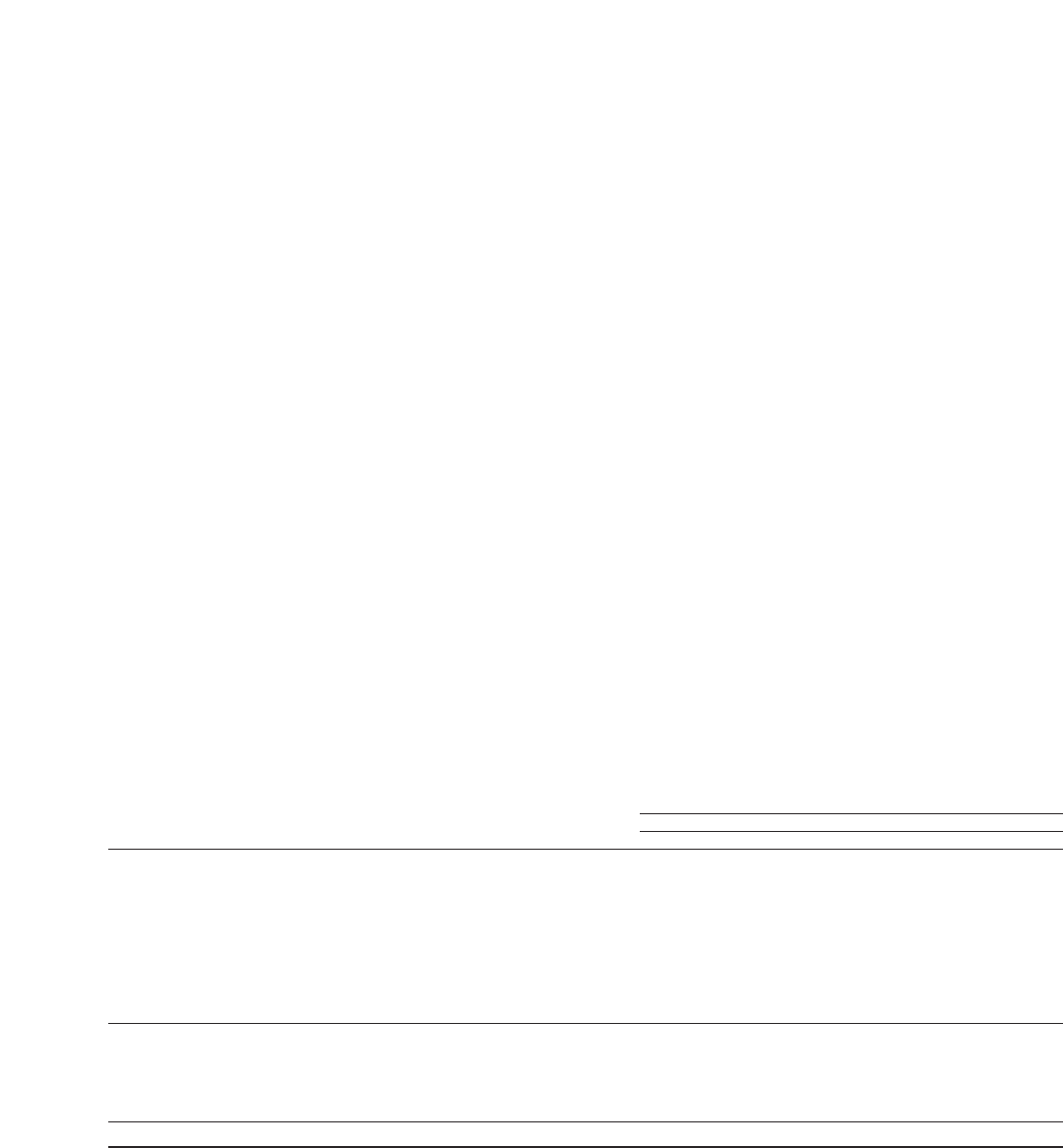

At December 31, 2001 and 2000, Series Preference Stock of PECO, no par value, consisted of 100,000,000 shares authorized,

of which no shares were outstanding. At December 31, 2001 and 2000, cumulative Preferred Stock of PECO, no par value,

consisted of 15,000,000 shares authorized and the amounts set forth below:

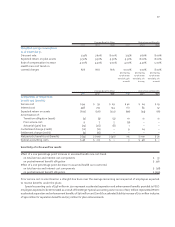

Current at December 31,

Redemption 2001 2000 2001 2000

Price(a) Shares Outstanding Dollar Amount

Series (without mandatory

redemption)

$ 4.68 $ 104.00 150,000 150,000 $ 15 $ 15

$ 4.40 112.50 274,720 274,720 27 27

$ 4.30 102.00 150,000 150,000 15 15

$ 3.80 106.00 300,000 300,000 30 30

$ 7.48 (b) 500,000 500,000 50 50

1,374,720 1,374,720 137 137

Series (with mandatory

redemption)

$ 6.12 (c) 185,400 370,800 19 37

Total preferred stock 1,560,120 1,745,520 $ 156 $ 174

(a) Redeemable, at the option of PECO, at the indicated dollar amounts per share, plus accrued dividends.

(b) None of the shares of this series is subject to redemption prior to April 1, 2003.

(c) PECO made the annual sinking fund payments of $18.5 million on August 1, 2001 and August 2,2000.The future sinking fund requirement in 2002 is $18.5 million.

At December 31, 2001, ComEd Prior Preferred Stock and ComEd Preference Stock consisted of 850,000 and 6,810,451 shares

authorized, respectively, none of which were outstanding.