ComEd 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

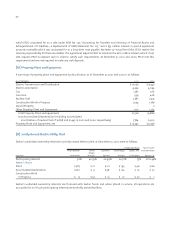

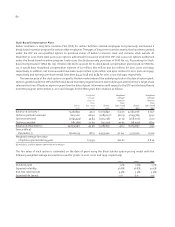

Stock-Based Compensation Plans

Exelon maintains a Long-Term Incentive Plan (LTIP) for certain full-time salaried employees and previously maintained a

broad-based incentive program for certain other employees.The types of long-term incentive awards that have been granted

under the LTIP are non-qualified options to purchase shares of Exelon’s common stock and common stock awards. At

December 31, 2001, there were 9,000,000 options authorized for issuance under the LTIP and 2,000,000 options authorized

under the broad-based incentive program. Exelon uses the disclosure-only provisions of SFAS No. 123, “Accounting for Stock-

Based Compensation” (SFAS No. 123). If Exelon elected to account for its stock-based compensation plans based on SFAS No.

123, it would have recognized compensation expense of $7 million, $60 million and $10 million, for 2001, 2000 and 1999,

respectively. In addition, net income would have been $1,421 million, $526 million and $560 million for 2001, 2000 and 1999,

respectively, and earnings per share would have been $4.41, $2.58 and $2.84 for 2001, 2000 and 1999, respectively.

The exercise price of the stock options is equal to the fair market value of the underlying stock on the date of option grant.

Options granted under the LTIP and the broad-based incentive program become exercisable upon attainment of a target share

value and/or time. All options expire 10 years from the date of grant. Information with respect to the LTIP and the broad-based

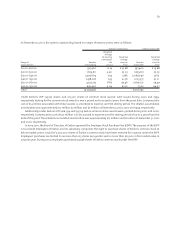

incentive program at December 31, 2001 and changes for the three years then ended, is as follows:

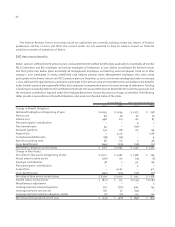

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

Price Price Price

Shares (per share) Shares (per share) Shares (per share)

2001 2001 2000 2000 1999 1999

Balance at January 1 15,287,859 42.13 6,065,897 $ 31.91 4,663,008 $ 27.71

Options granted/assumed 629,200 66.42 11,089,051(a) 46.09 2,049,789 39.32

Options exercised (1,695,474) 34.84 (1,725,058) 31.79 (568,000) 25.17

Options canceled (181,589) 52.64 (142,031) 39.95 (78,900) 38.14

Balance at December 31 14,039,996 43.96 15,287,859 42.13 6,065,897 31.91

Exercisable at

December 31 8,006,193 38.75 4,953,942 30.04 3,331,903 25.60

Weighted average fair value

of options granted during year $ 19.59 $16.62 $ 8.24

(a) Includes 5.3 million options converted in the Merger.

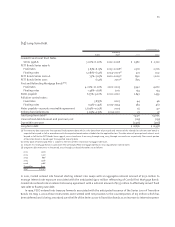

The fair value of each option is estimated on the date of grant using the Black-Scholes option-pricing model with the

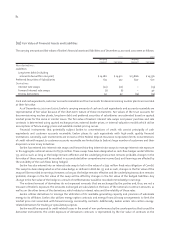

following weighted average assumptions used for grants in 2001, 2000 and 1999, respectively:

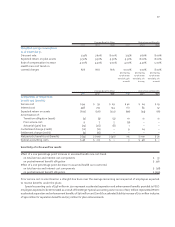

2001 2000 1999

Dividend yield 3.2% 3.6% 5.7%

Expected volatility 36.8% 36.8% 30.5%

Risk-free interest rate 4.9% 5.9% 5.9%

Expected life (years) 5.0 5.0 9.5