ComEd 2001 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

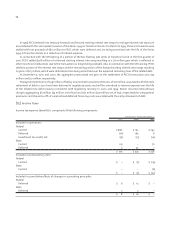

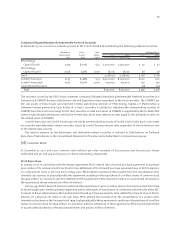

Net unrealized losses of $84 million and gains of $5 million were recognized in Accumulated Depreciation, Regulatory Assets

and Accumulated Other Comprehensive Income in Exelon’s Consolidated Balance Sheets at December 31, 2001 and 2000,

respectively.

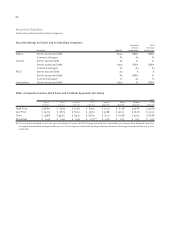

For the Years December 31

2001 2000

Proceeds from sales $ 1,624 $ 265

Gross realized gains 76 9

Gross realized losses (189) (46)

Net realized gains of $14 million and net realized losses of $37 million were recognized in Accumulated Depreciation and

Regulatory Assets in Exelon’s Consolidated Balance Sheets at December 31, 2001 and 2000, respectively and $127 million of net

realized losses was recognized in Other Income and Deductions in Exelon’s Consolidated Income Statements for 2001.

The available-for-sale securities held at December 31, 2001 have an average maturity of eight to ten years. The cost of

these securities was determined on the basis of specific identification. See Note 12—Nuclear Decommissioning and Spent

Fuel Storage for further information regarding the nuclear decommissioning trusts.

(20) Commitments and Contingencies

Capital Commitments

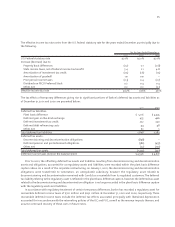

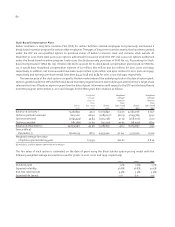

In December 2001, Generation agreed to purchase two generation plants located in the Dallas-Fort Worth metropolitan area

from TXU Corp. (TXU) to expand its presence in the Texas region. The $443 million purchase of the two natural-gas and oil-

fired plants, to be funded through available cash and commercial paper proceeds, will add approximately 2,300 megawatts

(MW) capacity. The transaction includes a power purchase agreement for TXU to purchase power during the months of May

through September from 2002 through 2006. During the periods covered by the power purchase agreement, TXU will make

fixed capacity payments and will provide fuel to Exelon in return for exclusive rights to the energy and capacity of the

generation plants. The closing of the acquisition is contingent upon receipt of the necessary regulatory approvals and is

anticipated to occur in the first quarter of 2002. Also, Exelon has committed to provide AmerGen with capital contributions

equivalent to 50% of the purchase price of any acquisitions AmerGen makes in 2002 and Exelon and British Energy have each

agreed to provide up to $100 million to AmerGen at any time for operating expenses.

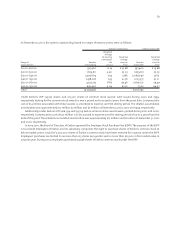

Nuclear Insurance

The Price-Anderson Act limits the liability of nuclear reactor owners for claims that could arise from a single incident. The

current limit is $9.5 billion and is subject to change to account for the effects of inflation and changes in the number of licensed

reactors. Through its subsidiaries, Exelon carries the maximum available commercial insurance of $200 million and the

remaining $9.3 billion is provided through mandatory participation in a financial protection pool. Under the Price-Anderson

Act, all nuclear reactor licensees can be assessed up to $89 million per reactor per incident, payable at no more than $10 million

per reactor per incident per year. This assessment is subject to inflation and state premium taxes. In addition, the U.S. Congress

could impose revenue-raising measures on the nuclear industry to pay claims.The Price-Anderson Act is scheduled to expire in

August 2002. Although replacement legislation has been proposed from time to time, Exelon is unable to predict whether

replacement legislation will be enacted.

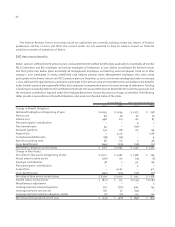

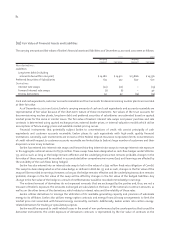

Exelon carries property damage, decontamination and premature decommissioning insurance for each station loss

resulting from damage to its nuclear plants. In the event of an accident, insurance proceeds must first be used for reactor

stabilization and site decontamination. If the decision is made to decommission the facility, a portion of the insurance proceeds

will be allocated to a fund, which Exelon is required by the Nuclear Regulatory Commission (NRC) to maintain, to provide for

decommissioning the facility. Exelon is unable to predict the timing of the availability of insurance proceeds to Exelon and the

amount of such proceeds which would be available. Under the terms of the various insurance agreements, Exelon could be