ComEd 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

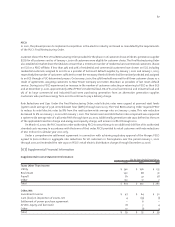

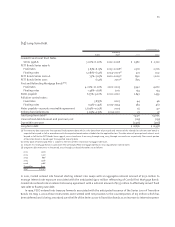

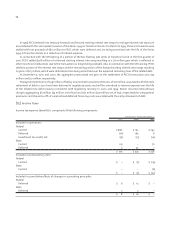

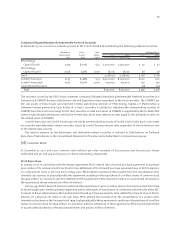

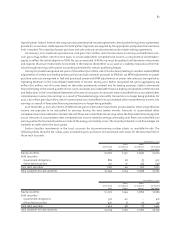

(14) Long-Term Debt

at December 31,

Maturity

Rates Date 2001 2000

ComEd Transitional Trust Notes

Series 1998-A: 5.00%–6.00% 2002–2008 $ 2,380 $ 2,720

PETT Bonds Series 1999-A:

Fixed rates 5.63%–6.13% 2003–2008(a) 2,561 2,706

Floating rates 5.081%–6.52% 2004–2007(a) 327 1,132

PETT Bonds Series 2000-A: 7.3%–7.65% 2002–2009(a) 890 1,000

PETT Bonds Series 2001: 6.52% 2010(a) 805 –

First and Refunding Mortgage Bonds(b)(c):

Fixed rates 4.00%–10.00% 2002–2023 3,942 4,260

Floating rates 1.46%–1.62% 2012 154 154

Notes payable 6.75%–9.20% 2002–2020 2,647 1,459

Pollution control notes:

Fixed rates 5.875% 2007 44 46

Floating rates 1.59%–2.45% 2009–2034 583 461

Notes payable—accounts receivable agreement 5.625%–10.25% 2005 55 40

Sinking fund debentures 3.125%–4.75% 2004–2011 23 27

Total Long-Term debt(d) 14,411 14,005

Unamortized debt discount and premium, net (129) (139)

Due within one year (1,406) (908)

Long-Term debt $12,876 $ 12,958

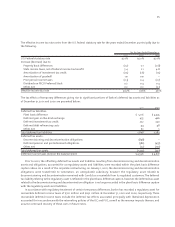

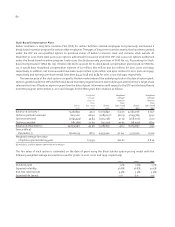

(a) The maturity date represents the expected final payment date which is the date when all principal and interest of the related class of transition bonds is

expected to be paid in full in accordance with the expected amortization schedule for the applicable class. The date when all principal and interest must

be paid in full for the PETT Bonds Series 1999-A, 2000-A and 2001-A are 2003 through 2009, 2003 through 2010 and 2010 respectively. The current portion

of transition bonds is based upon the expected maturity date.

(b) Utility plant of ComEd and PECO is subject to the liens of their respective mortgage indentures.

(c) Includes first mortgage bonds issued under the ComEd and PECO mortgage indentures securing pollution control notes.

(d) Long-term debt maturities in the period 2002 through 2006 and thereafter are as follows:

2002 1,406

2003 1,391

2004 896

2005 1,308

2006 1,268

Thereafter 8,142

Total $ 14,411

In 2001, ComEd entered into forward starting interest rate swaps with an aggregate notional amount of $250 million to

manage interest rate exposure associated with the anticipated $400 million refinancing of ComEd First Mortgage Bonds.

ComEd also entered into an interest rate swap agreement with a notional amount of $235 million to effectively convert fixed

rate debt to floating rate debt.

In 1999, PECO entered into treasury forwards associated with the anticipated issuance of the Series 2000-A Transition

Bonds. On May 2, 2000, these instruments were settled with net proceeds to the counterparties of $13 million which has

been deferred and is being amortized over the life of the Series 2000-A Transition Bonds as an increase to interest expense.