ComEd 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

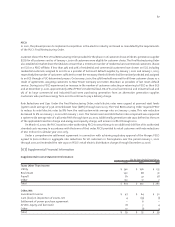

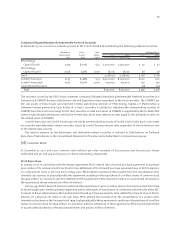

(12) Nuclear Decommissioning and Spent Fuel Storage

Exelon has an obligation to decommission its nuclear power plants. Exelon’s current estimate of its nuclear facilities’

decommissioning cost for its owned nuclear power plants is $7.2 billion in current year (2002) dollars. These expenditures

are expected to occur after the plants retirement, estimated to begin in 2045. Decommissioning costs are currently

recoverable through regulated rates. Under rates in effect through December 31, 2001, Exelon collected approximately $102

million in 2001 from customers. At December 31, 2001 the decommissioning liability recorded in Accumulated Depreciation

and Deferred Credits and Other Liabilities on Exelon’s Consolidated Balance Sheets, was $2.7 billion and $1.3 billion,

respectively. At December 31, 2000 the decommissioning liability, recorded in Accumulated Depreciation and Deferred

Credits and Other Liabilities on Exelon’s Consolidated Balance Sheets, was $2.6 billion and $1.3 billion, respectively. In order

to fund future decommissioning costs, at December 31, 2001 and 2000, Exelon held $3.2 billion and $3.1 billion, respectively,

in trust accounts which are included as Investments in Exelon’s Consolidated Balance Sheets at their fair market value.

Exelon believes that the amounts being recovered from customers through regulated rates and earnings on nuclear

decommissioning trust funds will be sufficient to fully fund its decommissioning obligations.

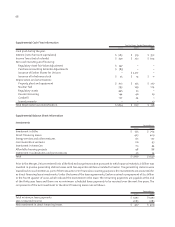

In connection with the transfer of ComEd’s nuclear generating stations to Generation, ComEd asked the ICC to approve

the continued recovery of decommissioning costs after the transfer. On December 20, 2000, the ICC issued an order finding

that the ICC has the legal authority to permit ComEd to continue to recover decommissioning costs from customers for the

six-year term of the power purchase agreements between ComEd and Generation. Under the ICC order, ComEd is permitted

to recover $73 million per year from customers for decommissioning for the years 2001 through 2004. In 2005 and 2006,

ComEd can recover up to $73 million annually, depending upon the portion of the output of the former ComEd nuclear

stations that ComEd purchases from Generation. Under the ICC order, subsequent to 2006, there will be no further recoveries

of decommissioning costs from customers. The ICC order also provides that any surplus funds after the nuclear stations are

decommissioned must be refunded to customers. The amount of recovery in the ICC order is less than the $84 million annual

amount ComEd recovered in 2000. The ICC order is currently pending on appeal in the Illinois Appellate Court.

To account for the effects of the ICC order, in the first quarter of 2001 ComEd reduced its nuclear decommissioning

regulatory asset to $372 million, reflecting the reduction in expected probable future recoveries from customers through

2006. The reduction in the regulatory asset in the amount of $347 million was recorded as an adjustment to the initial

purchase price allocation relating to the asset and resulted in a corresponding increase in goodwill. Also, ComEd recorded an

obligation to Generation of approximately $440 million representing ComEd’s legal requirement to remit funds to

Generation for the remaining regulatory asset amount of $372 million upon collection from customers, and for collections

from customers prior to the establishment of external decommissioning trust funds in 1989 to be remitted to Generation for

deposit into the decommissioning trusts through 2006. Unrealized gains and losses on decommissioning trust funds (based

on the market value of the assets on the Merger date, in accordance with purchase accounting) had previously been recorded

in accumulated depreciation or regulatory assets. As a result of the transfer of the ComEd nuclear plants to Generation and

the ICC order limiting the regulated recoveries of decommissioning costs, net unrealized losses of $23 million (net of income

taxes) at that date were reclassified to accumulated other comprehensive income. All subsequent realized gains and losses

on these decommissioning trust funds’ assets are based on the cost basis of the trust fund assets established on the Merger

date and are reflected in Other Income and Deductions in Exelon’s Consolidated Statements of Income.

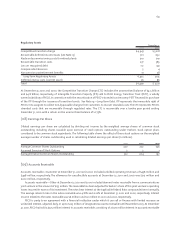

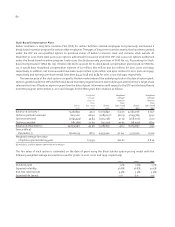

Under the Nuclear Waste Policy Act of 1982 (NWPA), the U.S. Department of Energy (DOE) is responsible for the selection

and development of repositories for, and the disposal of, spent nuclear fuel (SNF) and high-level radioactive waste. ComEd

and PECO, as required by the NWPA, each signed a contract with the DOE (Standard Contract) to provide for disposal of SNF

from their respective nuclear generating stations. In accordance with the NWPA and the Standard Contract, ComEd and

PECO pay the DOE one mill ($.001) per kilowatt-hour of net nuclear generation for the cost of nuclear fuel long-term storage

and disposal. This fee may be adjusted prospectively in order to ensure full cost recovery. The NWPA and the Standard

Contract required the DOE to begin taking possession of SNF generated by nuclear generating units by no later than January

1998. The DOE, however, failed to meet that deadline and its performance is expected to be delayed significantly. The DOE’s

current estimate for opening a SNF facility is 2010. This extended delay in SNF acceptance by the DOE has led to Exelon’s

adoption of dry storage at its Dresden and Peach Bottom Units and its consideration of dry storage at other units.