ComEd 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

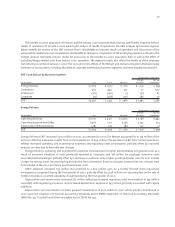

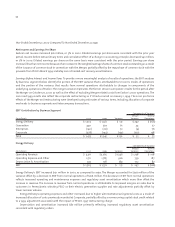

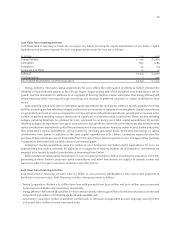

Cash Flows from Investing Activities

Cash flows used in investing activities for 2001 were $2.4 billion, primarily for capital expenditures of $2.0 billion. Capital

expenditures by business segment for 2001 and projected amounts for 2002 are as follows:

(in millions) 2001 2002

Energy Delivery $1,133 $ 1,060

Generation 803 1,089

Enterprises 70 114

Corporate and Other 35 27

Subtotal $2,041 $ 2,290

TXU Acquisition –443

Total Capital Expenditures and TXU Acquisition $ 2,041 $ 2,733

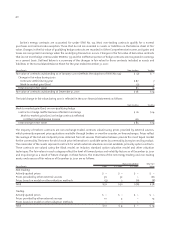

Energy Delivery’s estimated capital expenditures for 2002 reflect the continuation of efforts to further improve the

reliability of its distribution system in the Chicago region. Approximately 36% of the budgeted 2002 expenditures are for

growth and the remainder for additions to or upgrades of existing facilities. Exelon anticipates that Energy Delivery will

obtain financing, when necessary, through borrowings, the issuance of preferred securities, or capital contributions from

Exelon.

Approximately 75% of Generation’s estimated capital expenditures for 2002 are for additions to and upgrades of existing

facilities (including nuclear refueling outages), nuclear fuel and increases in capacity at existing plants. Capital expenditures

are projected to increase in 2002 as compared to 2001 due to higher nuclear fuel expenditures, growth and an increase in the

number of planned refueling outages, during which significant maintenance work is performed. Eleven nuclear refueling

outages, including AmerGen, are planned for 2002, compared to six during 2001. Total capital expenditures for nuclear

refueling outages are expected to increase in 2002 over 2001 by $24 million. Exelon has committed to provide AmerGen with

capital contributions equivalent to 50% of the purchase price of any acquisitions AmerGen makes in 2002. Exelon anticipates

that Generation’s capital expenditures will be funded by internally generated funds, Generation borrowings or capital

contributions from Exelon. In addition to the 2002 capital expenditures of $1.1 billion, Generation expects to close the

purchase of two natural-gas and oil-fired plants from TXU Corp. (TXU) in the first quarter of 2002. The $443 million purchase

is expected to be funded with available cash and commercial paper.

Enterprises’ capital expenditures were $70 million in 2001. Enterprises’ estimated capital expenditures for 2002 are

approximately $114 million, primarily for additions to or upgrades of existing facilities. All of Enterprises’ investments are

expected to be funded by capital contributions or borrowings from Exelon.

Exelon’s total estimated capital expenditures in 2002 are approximately $2.7 billion including the acquisition of the TXU

generating stations. Exelon’s proposed capital expenditures and other investments are subject to periodic review and

revision to reflect changes in economic conditions and other factors.

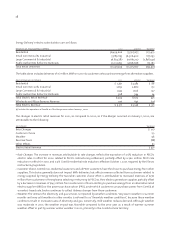

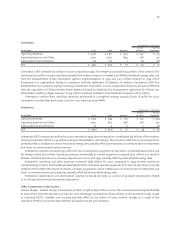

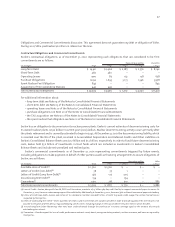

Cash Flows from Financing Activities

Cash flows used in financing activities were $1.3 billion in 2001 primarily attributable to debt service and payments of

dividends on common stock. Debt financing activities during 2001 were as follows:

– Exelon Corporation—Retired a $1.2 billion term loan with proceeds from $500 million and $700 million senior unsecured

note issuances at Exelon and Generation, respectively.

– Energy Delivery—Refinanced $805 million in PECO transition bonds, retired $340 million of ComEd transitional trust notes and

early retired $196 million in First Mortgage Bonds with available cash.

– Generation—Issued $121 million of pollution control bonds to refinance an equivalent amount originally issued by PECO

and issued $700 million of senior unsecured notes.