Albertsons 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

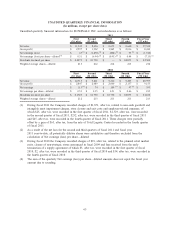

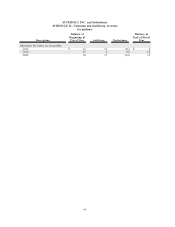

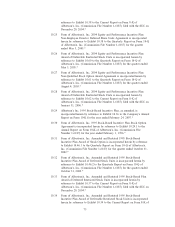

UNAUDITED QUARTERLY FINANCIAL INFORMATION

(In millions, except per share data)

Unaudited quarterly financial information for SUPERVALU INC. and subsidiaries is as follows:

First

(16 wks)

Second

(12 wks)

Third

(12 wks)

Fourth

(12 wks)

Fiscal Year

(52 wks)

2011

Net sales $ 11,545 $ 8,656 $ 8,673 $ 8,660 $ 37,534

Gross profit $ 2,597 $ 1,932 $ 1,865 $ 2,016 $ 8,410

Net earnings (loss) $ 67

(1)

$ (1,470)

(1)

$ (202)

(1)

$95

(1)

$ (1,510)

Net earnings (loss) per share—diluted

(4)

$ 0.31 $ (6.94)

(2)

$ (0.95)

(2)

$ 0.44 $ (7.13)

(2)

Dividends declared per share $ 0.0875 $ 0.1750 $ — $ 0.0875 $ 0.3500

Weighted average shares—diluted 213 212 212 213 212

First

(16 wks)

Second

(12 wks)

Third

(12 wks)

Fourth

(12 wks)

Fiscal Year

(52 wks)

2010

Net sales $ 12,715 $ 9,461 $ 9,216 $ 9,205 $ 40,597

Gross profit $ 2,847 $ 2,089 $ 2,060 $ 2,157 $ 9,153

Net earnings $ 113

(3)

$ 74 $ 109

(3)

$97

(3)

$ 393

Net earnings per share—diluted $ 0.53 $ 0.35 $ 0.51 $ 0.46 $ 1.85

Dividends declared per share $ 0.1725 $ 0.1750 $ 0.1750 $ 0.0875 $ 0.6100

Weighted average shares—diluted 212 213 213 213 213

(1) During fiscal 2011 the Company recorded charges of $1,871, after tax, related to non-cash goodwill and

intangible asset impairment charges, store closure and exit costs and employee-related expenses, of

which $25, after tax, were recorded in the first quarter of fiscal 2011, $1,529, after tax, were recorded

in the second quarter of fiscal 2011, $252, after tax, were recorded in the third quarter of fiscal 2011

and $65, after tax, were recorded in the fourth quarter of fiscal 2011. These charges were partially

offset by a gain of $65, after tax, from the sale of Total Logistic Control recorded in the fourth quarter

of fiscal 2011.

(2) As a result of the net loss for the second and third quarters of fiscal 2011 and fiscal year

2011 year-to-date, all potentially dilutive shares were antidilutive and therefore excluded from the

calculation of Net earnings (loss) per share—diluted.

(3) During fiscal 2010 the Company recorded charges of $39, after tax, related to the planned retail market

exits, closure of non-strategic stores announced in fiscal 2009 and fees received from the early

termination of a supply agreement of which $3, after tax, were recorded in the first quarter of fiscal

2010, $2, after tax, were recorded in the third quarter of fiscal 2010 and $34, after tax, were recorded in

the fourth quarter of fiscal 2010.

(4) The sum of the quarterly Net earnings (loss) per share—diluted amounts does not equal the fiscal year

amount due to rounding.

65