Albertsons 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

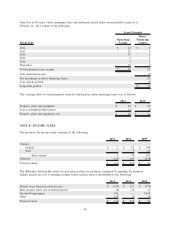

Net periodic benefit expense (income) for defined benefit pension plans and other postretirement benefit plans

consisted of the following:

Net Periodic Benefit Cost 2011 2010 2009 2011 2010 2009

Pension Benefits Other Postretirement Benefits

Service cost $ 8 $ 6 $ 7 $ 2 $ 2 $ 1

Interest cost 137 138 129 8 8 10

Expected return on plan assets (123) (129) (142) — — —

Amortization of prior service

benefit — — — (6) (6) (1)

Amortization of net actuarial

loss 65 10 1223

Settlement 9 2 — — — —

Net periodic benefit expense

(income) 96 27 (5) 6 6 13

Other Changes in Plan

Assets and Benefit

Obligations Recognized in

Other Comprehensive

Income (Loss)

Prior service benefit —————(38)

Amortization of prior service

benefit — — — 6 6 1

Net actuarial loss (gain) (12) (42) 707 13 10 3

Amortization of net actuarial

loss (65) (10) (1) (2) (2) (3)

Total recognized in other

comprehensive income

(loss) (77) (52) 706 17 14 (37)

Total recognized in net

periodic benefit expense

and other comprehensive

income (loss) $ 19 $ (25) $ 701 $ 23 $ 20 $ (24)

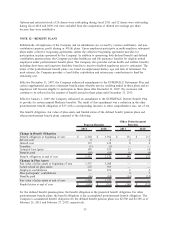

The estimated net actuarial loss that will be amortized from accumulated other comprehensive losses into net

periodic benefit cost for the defined benefit pension plans during fiscal 2012 is $93. The estimated net amount

of prior service benefit and net actuarial loss for the postretirement benefit plans that will be amortized from

accumulated other comprehensive losses into net periodic benefit cost during fiscal 2012 is $2.

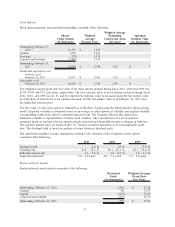

Assumptions

Weighted average assumptions used to determine benefit obligations and net periodic benefit cost consisted of

the following:

2011 2010 2009

Benefit obligation assumptions:

Discount rate

(2)

5.60% 6.00% 7.35%

Rate of compensation increase 2.00% 3.00% 3.25%

Net periodic benefit cost assumptions:

(1)

Discount rate

(2)

6.00% 7.35% 6.75%

Rate of compensation increase 3.00% 3.25% 3.75%

Expected return on plan assets

(3)

7.75% 8.00% 8.00%

(1) Net periodic benefit cost is measured using weighted average assumptions as of the beginning of each

year.

57