Albertsons 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

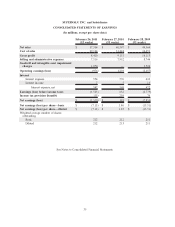

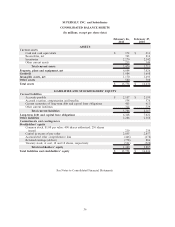

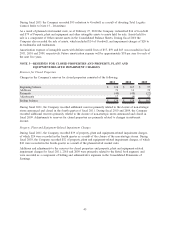

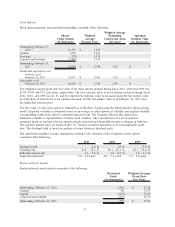

NOTE 2—GOODWILL AND INTANGIBLE ASSETS

Changes in the Company’s Goodwill and Intangible assets consisted of the following:

February 28,

2009 Additions Impairments

Other net

adjustments

February 27,

2010 Additions Impairments

Other net

adjustments

February 26,

2011

Goodwill:

Retail food goodwill $ 6,164 $ — $ — $ (50) $ 6,114 $ — $ — $ 2 $ 6,116

Accumulated

impairment losses (3,223) — — — (3,223) — (1,619) — (4,842)

Total Retail food

goodwill, net 2,941 — — (50) 2,891 — (1,619) 2 1,274

Supply chain services

goodwill 807 — — — 807 — — (97) 710

Total goodwill $ 3,748 $ — $ — $ (50) $ 3,698 $ — $ (1,619) $ (95) $ 1,984

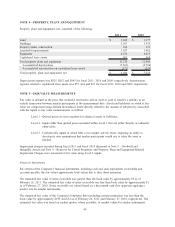

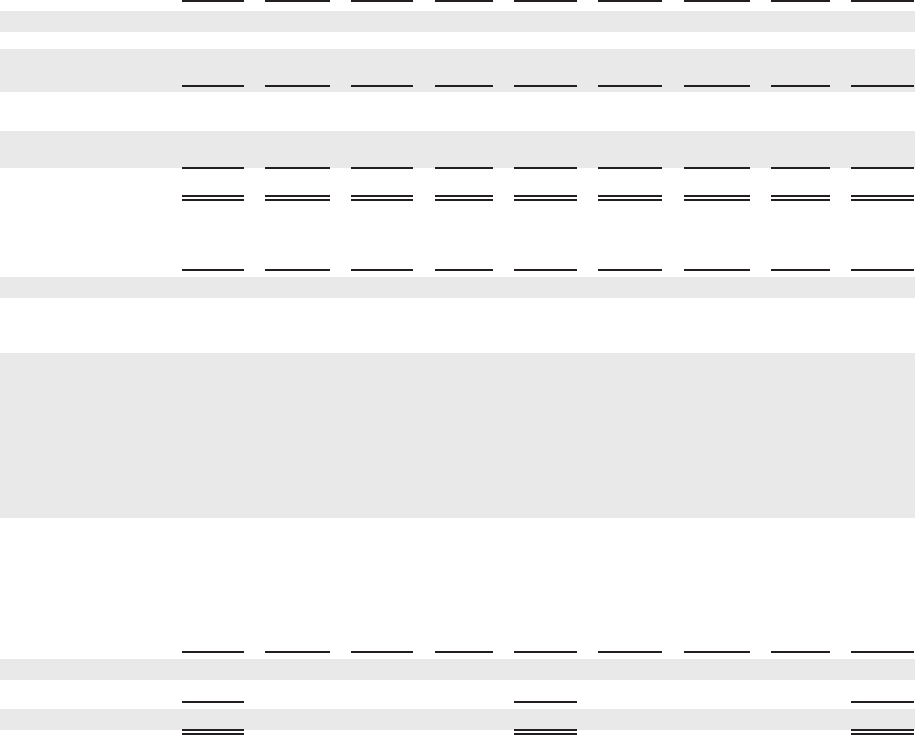

February 28,

2009

Additions/

Amortization Impairments

Other net

adjustments

February 27,

2010

Additions/

Amortization Impairments

Other net

adjustments

February 26,

2011

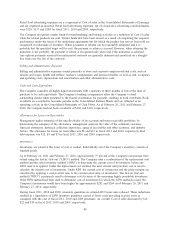

Intangible assets:

Trademarks and

tradenames –

indefinite useful lives $ 1,069 $ — $ (20) $ — $ 1,049 $ — $ (251) $ (18) $ 780

Favorable operating

leases, customer lists,

customer

relationships and

other (accumulated

amortization of $280

and $238 as of

February 26, 2011

and February 27,

2010, respectively) 706 8 — (40) 674 12 — (23) 663

Non-compete

agreements

(accumulated

amortization of $4

and $5 as of

February 26, 2011

and February 27,

2010, respectively) 10 1 — 2 13 1 — (3) 11

Total intangible assets 1,785 9 (20) (38) 1,736 13 (251) (44) 1,454

Accumulated amortization (201) (59) — 17 (243) (57) — 16 (284)

Total intangible assets, net $ 1,584 $ 1,493 $ 1,170

The Company applies a fair value based impairment test to the net book value of goodwill and intangible

assets with indefinite useful lives on an annual basis and on an interim basis if certain events or circumstances

indicate that an impairment loss may have occurred. The Company undertook reviews for impairment of

goodwill and intangible assets with indefinite useful lives twice during the year. During the second quarter of

fiscal 2011 the Company’s stock price had a significant and sustained decline and book value per share

substantially exceeded the stock price. As a result, the Company completed an impairment review and

recorded non-cash impairment charges of $1,840 related to the Retail food segment, comprised of a $1,619

reduction to the carrying value of goodwill and a $221 reduction to the carrying value of intangible assets

with indefinite useful lives.

The result of the annual review of goodwill undertaken in the fourth quarter indicated no reduction to the

carrying value of goodwill was required. The result of the annual fourth quarter impairment review of

intangible assets with indefinite useful lives indicated that the carrying value of certain Acquired Trademarks

exceeded their estimated fair value based on projected future revenues and recorded non-cash impairment

charges of $30 related to the Retail food segment.

The impairment of goodwill and indefinite-lived intangible assets reflects the significant decline in the market

capitalization and the weak economy.

44