Albertsons 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During fiscal 2011 the Company recorded $95 reduction to Goodwill as a result of divesting Total Logistic

Control. Refer to Note 15 – Divestiture.

As a result of planned retail market exits, as of February 27, 2010 the Company reclassified $36 of Goodwill

and $79 of Property, plant and equipment and other intangible assets to assets held for sale. Assets held for

sale is a component of Other current assets in the Consolidated Balance Sheets. During fiscal 2010 the

Company also recorded the sale of assets, which included $14 of Goodwill, and impairment charges of $20 to

its trademarks and tradenames.

Amortization expense of intangible assets with definite useful lives of $57, $59 and $65 was recorded in fiscal

2011, 2010 and 2009, respectively. Future amortization expense will be approximately $38 per year for each of

the next five years.

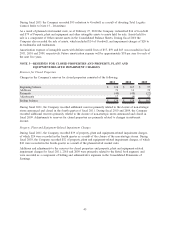

NOTE 3—RESERVES FOR CLOSED PROPERTIES AND PROPERTY, PLANT AND

EQUIPMENT-RELATED IMPAIRMENT CHARGES

Reserves for Closed Properties

Changes in the Company’s reserves for closed properties consisted of the following:

2011 2010 2009

Beginning balance $ 128 $ 167 $ 97

Additions 73 13 70

Payments (40) (48) (22)

Adjustments 17 (4) 22

Ending balance $ 178 $ 128 $ 167

During fiscal 2011, the Company recorded additional reserves primarily related to the closure of non-strategic

stores announced and closed in the fourth quarter of fiscal 2011. During fiscal 2010 and 2009, the Company

recorded additional reserves primarily related to the closure of non-strategic stores announced and closed in

fiscal 2009. Adjustments to reserves for closed properties are primarily related to changes in subtenant

income.

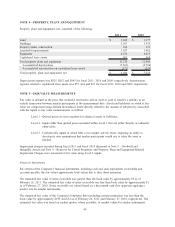

Property, Plant and Equipment-Related Impairment Charges

During fiscal 2011, the Company recorded $39 of property, plant and equipment-related impairment charges,

of which $24 were recorded in the fourth quarter as a result of the closure of the non-strategic stores. During

fiscal 2010, the Company recorded $52 of property, plant and equipment-related impairment charges, of which

$43 were recorded in the fourth quarter as a result of the planned retail market exits.

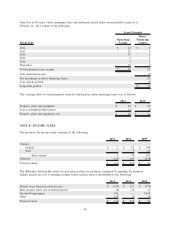

Additions and adjustments to the reserves for closed properties and property, plant and equipment-related

impairment charges for fiscal 2011, 2010 and 2009 were primarily related to the Retail food segment, and

were recorded as a component of Selling and administrative expenses in the Consolidated Statements of

Earnings.

45