Albertsons 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Labor unions

As of February 26, 2011, the Company is a party to 238 collective bargaining agreements covering

approximately 88,000 of its employees, of which 59 collective bargaining agreements covering approximately

26,000 employees are scheduled to expire in fiscal 2012. These expiring agreements cover approximately

30 percent of the Company’s union-affiliated employees. In addition, during fiscal 2011, 37 collective bargaining

agreements covering approximately 2,000 employees expired without their terms being renegotiated. Negotiations

are expected to continue with the bargaining units representing the employees subject to those agreements. In

future negotiations with labor unions, the Company expects that, among other issues, rising healthcare, pension

and employee benefit costs will be important topics for negotiation. There can be no assurance that the

Company will be able to negotiate the terms of expiring or expired agreements in a manner acceptable to the

Company. Therefore, potential work disruptions from labor disputes may disrupt the Company’s businesses and

adversely affect the Company’s financial condition and results of operations.

Costs of employee benefits

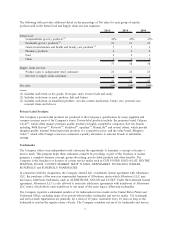

The Company provides health benefits and sponsors defined pension and other post-retirement plans for

substantially all employees not participating in multi-employer health and pension plans. The Company’s costs to

provide such benefits continue to increase annually and recent legislative and private sector initiatives regarding

healthcare reform could result in significant changes to the U.S. healthcare system. The Company is not able at this

time to determine the impact that healthcare reform could have on the Company-sponsored medical plans.

In addition, the Company participates in various multi-employer health and pension plans for a majority of its

union-affiliated employees, and the Company is required to make contributions to these plans in amounts

established under collective bargaining agreements. The costs of providing benefits through such plans have

escalated rapidly in recent years. The amount of any increase or decrease in the Company’s required

contributions to these multi-employer plans will depend upon many factors, including the outcome of

collective bargaining, actions taken by trustees who manage the plans, government regulations, the actual

return on assets held in the plans and the potential payment of a withdrawal liability if the Company chooses

to exit a market. Increases in the costs of benefits under these plans coupled with adverse stock market

developments that have reduced the return on plan assets have caused some multi-employer plans in which the

Company participates to be underfunded. The unfunded liabilities of these plans may result in increased future

payments by the Company and the other participating employers. The Company’s risk of such increased

payments may be greater if any of the participating employers in these underfunded plans withdraws from the

plan due to insolvency and is not able to contribute an amount sufficient to fund the unfunded liabilities

associated with its participants in the plan. The Great Atlantic & Pacific Tea Company (“A&P”) filed for

bankruptcy on December 12, 2010, and is a participant in five multi-employer plans with the Company. Based

on the information available to the Company the impact of the A&P bankruptcy on the Company’s future

payments or unfunded liabilities is not currently probable or reasonably estimable.

If the Company is unable to control healthcare and pension costs, the Company may experience increased

operating costs, which may adversely affect the Company’s financial condition and results of operations.

Governmental regulations

The Company’s businesses are subject to various federal, state and local laws, regulations and administrative

practices. These laws require the Company to comply with numerous provisions regulating health and sanitation

standards, equal employment opportunity, minimum wages and licensing for the sale of food, drugs and alcoholic

beverages. The Company’s inability to timely obtain permits, comply with government regulations or make capital

expenditures required to maintain compliance with governmental regulations may adversely impact the Company’s

business operations and prospects for future growth and its ability to participate in federal and state healthcare

programs. In addition, the Company cannot predict the nature of future laws, regulations, interpretations or

applications, nor can the Company determine the effect that additional governmental regulations or administrative

orders, when and if promulgated, or disparate federal, state and local regulatory schemes would have on the

Company’s future business. They may, however, impose additional requirements or restrictions on the products the

12