Albertsons 2011 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

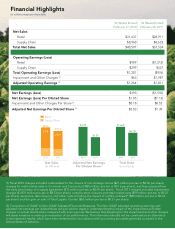

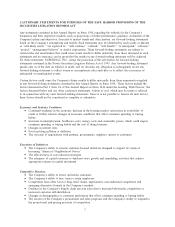

Net Sales

(In billions)

Adjusted Net Earnings

Per Diluted Share(2)

2011

$37.5

28.9

2010

$40.6

31.6

2010

$2.03

2011

$1.39

Total Debt

(In billions)

2010

$7.635

2011

$6.751

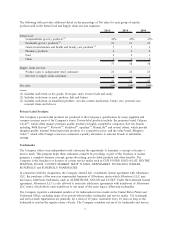

Retail

Supply Chain

9.0 8.6

52 Weeks Ended

February 27, 2010

52 Weeks Ended

February 26, 2011

Net Sales

Retail $31,637 $28,911

Supply Chain $8,960 $8,623

Total Net Sales $40,597 $37,534

Operating Earnings (Loss)

Retail $989 ($1,212)

Supply Chain $299 $337

Total Operating Earnings (Loss) $1,201 ($976)

Impairment and Other Charges (1) $63 $1,987

Adjusted Operating Earnings (2) $1,264 $1,011

Net Earnings (Loss) $393 ($1,510)

Net Earnings (Loss) Per Diluted Share $1.85 ($7.13)

Impairment and Other Charges Per Share (1) $0.18 $8.52)

Adjusted Net Earnings Per Diluted Share (2) $2.03 $1.39)

(1) Fiscal 2010 charges included costs related to the closure of non-strategic stores ($21 million pre-tax or $0.06 per share),

charges for retail market exits in Cincinnati and Connecticut ($55 milliion pre-tax or $0.16 per share), and fees received from

the early termination of a supply agreement ($13 million pre-tax or $0.04 per share). Fiscal 2011 charges included impairment

charges ($1,870 million pre-tax or $8.23 per share), costs for store closures and retail market exits ($99 million pre-tax or $0.37

per share), severance, labor buyout, and other costs including the impact of a strike at Shaw’s® ($80 million pre-tax or $0.23

per share) and the gain on sale of Total Logistic Control ($62 million pre-tax or $0.31 per share).

(2) Comparison of GAAP to Non-GAAP Adjusted Financial Measures. The Non-GAAP adjusted operating earnings and

adjusted net earnings per diluted share are provided to assist in understanding the impact of the impairment and other

charges on actual results when compared with prior periods. We believe that adjusting for the impairment and other charges

will assist investors in making an evaluation of our performance. This information should not be construed as an alternative

to the reported results, which have been determined in accordance with accounting principles generally accepted in the

United States of America.

Financial Highlights

(In millions except per share data)