Albertsons 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.speculative purposes. The Company enters into energy commitments that it expects to utilize in the normal

course of business.

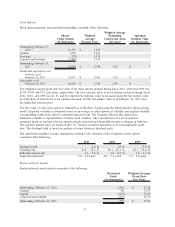

Stock-based Compensation

The Company uses the straight-line method to recognize compensation expense based on the fair value on the

date of grant, net of the estimated forfeiture rate, over the requisite service period related to each award. The

fair value of stock options is estimated using the Black-Scholes option pricing model, which incorporates

certain assumptions, such as risk-free interest rate, expected volatility, expected dividend yield and expected

life of options.

Income Taxes

Deferred income taxes represent future net tax effects resulting from temporary differences between the

financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which

the differences are expected to be settled or realized.

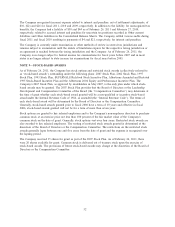

The Company is currently in various stages of audits, appeals or other methods of review with taxing

authorities from various taxing jurisdictions. The Company establishes liabilities for unrecognized tax benefits

in a variety of taxing jurisdictions when, despite management’s belief that the Company’s tax return positions

are supportable, certain positions may be challenged and may need to be revised. The Company adjusts these

liabilities in light of changing facts and circumstances, such as the progress of a tax audit. The Company also

provides interest on these liabilities at the appropriate statutory interest rate. The Company recognizes interest

related to unrecognized tax benefits in interest expense and penalties in Selling and administrative expenses in

the Consolidated Statements of Earnings.

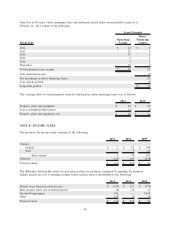

Net Earnings (Loss) Per Share

Basic net earnings (loss) per share is calculated using net earnings (loss) available to stockholders divided by

the weighted average number of shares outstanding during the period. Diluted net earnings (loss) per share is

similar to basic net earnings (loss) per share except that the weighted average number of shares outstanding is

after giving effect to the dilutive impacts of stock options, restricted stock awards and outstanding convertible

securities. In addition, for the calculation of diluted net earnings (loss) per share, net earnings (loss) is

adjusted to eliminate the after-tax interest expense recognized during the period related to contingently

convertible debentures if dilutive.

Recently Adopted Accounting Standards

In June 2009, the Financial Accounting Standards Board (“FASB”) amended its existing standards related to

the consolidation of a variable interest entity (“VIE”), which was effective for interim and annual fiscal

periods beginning after November 15, 2009. The new standards require an entity to analyze whether its

variable interests give it a controlling financial interest of a VIE and outlines what defines a primary

beneficiary. The new standards amend generally accepted accounting principles by: (a) changing certain rules

for determining whether an entity is a VIE; (b) replacing the quantitative approach previously required for

determining the primary beneficiary with a more qualitative approach; and (c) requiring entities to

continuously analyze whether they are the primary beneficiary of a VIE, among other amendments. The new

standards also require enhanced disclosures regarding an entity’s involvement in a VIE. The Company adopted

the amended standards effective February 28, 2010. The adoption of these new standards did not have a

material effect on the Company’s Consolidated Financial Statements.

43