Albertsons 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Craig R. Herkert

Chief Executive Officer

Dear SUPERVALU Stockholders,

Fiscal 2011 was a year of transition for SUPERVALU. We made significant changes to further leverage our

scale and improve operational agility as we continue our journey to become “America’s Neighborhood

Grocer.”

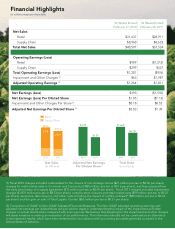

This year’s results were disappointing and reflect our extended timeline for enhancing our fresh offering,

sharpening retail pricing and redirecting SUPERVALU’s focus on hyperlocal retailing. Adjusted earnings for

the year were $296 million on sales of $37.5 billion and identical store sales fell by six percent.

Fiscal 2011 was a pivotal year in which we made a number of important structural changes and accomplished

several noteworthy objectives:

•Aligned Merchandising and Procurement Teams. We placed a single leader over our merchandising and

logistics functions to improve coordination and realize procurement efficiencies throughout the organization.

This alignment allows SUPERVALU to streamline interactions with vendor partners and leverage the

procurement capacity of our 1,114 traditional stores and the 2,700 retail affiliate stores we serve through our

wholesale business.

•Monetized Non-Core Assets. We shed non-core assets with the sale of retail stores in Connecticut and

Cincinnati, our Bristol Farms banner and Total Logistic Control. These moves allow us to hone our

resources on core retail banners and provided incremental capital to retire corporate debt.

•Accelerated Debt Pay Down. We reduced total debt by approximately $885 million in fiscal 2011,

exceeding our initial target by more than $280 million, and successfully extended a portion of our revolving

credit facility by five years. Since the Albertson’s acquisition in 2006, SUPERVALU has reduced total debt

by more than $2.75 billion.

•Expanded Save-A-Lot. We opened 142 new hard-discount Save-A-Lot stores, including ten co-branded

locations operated by Rite-Aid and six Hispanic-oriented stores in Texas. Fiscal 2011 marks the first year

since 2005 that Save-A-Lot has meaningfully grown its retail store count. The company remains on track to

double Save-A-Lot’s footprint to 2,400 locations by the end of fiscal 2015.

•Solidified Independent Business. We improved productivity across the Supply Chain network and affiliated

notable new business. This helped to offset volume lost due to a national retail customer’s transition of

certain volume to self-distribution, the acquisition of a sizable customer by a competitor and other normal

attrition. Our introduction of new automation technology – including a facility in Lancaster, PA which

became fully operational this year – is also delivering productivity above expected levels.

•Realized Significant Cost Savings. SUPERVALU removed $175 million from its cost structure through the

consolidation of administrative functions, procurement efficiencies and facilities management.

Perhaps the most important development of the past year was the formalization of SUPERVALU’s business

transformation initiative. A detailed plan was developed in fiscal 2011 that will make our everyday, non-

promoted prices more competitive, improve our retail execution and allow our store directors flexibility to

tailor their stores to the unique needs of their neighborhoods. At the core of this transformation is a change to