Albertsons 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

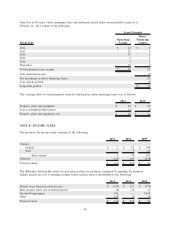

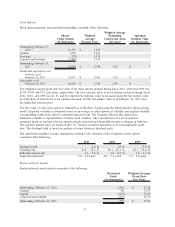

Compensation Expense

The components of pre-tax stock-based compensation expense (included primarily in Selling and

administrative expenses in the Consolidated Statements of Earnings) and related tax benefits were as follows:

2011 2010 2009

Stock-based compensation $ 15 $ 31 $ 44

Income tax benefits (6) (12) (17)

Stock-based compensation (net of tax) $ 9 $ 19 $ 27

The Company realized excess tax benefits (shortfalls) of $(2), $(1), and $1 related to stock-based awards

during fiscal 2011, 2010 and 2009, respectively.

Unrecognized Compensation Expense

As of February 26, 2011, there was $21 of unrecognized compensation expense related to unvested stock-

based awards granted under the Company’s stock plans. The expense is expected to be recognized over a

weighted average remaining vesting period of approximately two years.

NOTE 10—TREASURY STOCK PURCHASE PROGRAM

On June 24, 2010, the Board of Directors of the Company adopted and announced a new annual share

purchase program authorizing the Company to purchase up to $70 of the Company’s common stock. Stock

purchases will be made primarily from the cash generated from the settlement of stock options. This annual

authorization program replaced the previously existing share purchase program and continues through June

2011. As of February 26, 2011, there remained $70 available to repurchase the Company’s common stock.

During fiscal 2011, the Company purchased 0.2 shares under the previously existing share purchase program

at an average cost of $12.97 per share. The Company did not purchase any shares during fiscal 2010. During

2009 the Company purchased 0.2 shares under former share repurchase programs.

NOTE 11—NET EARNINGS (LOSS) PER SHARE

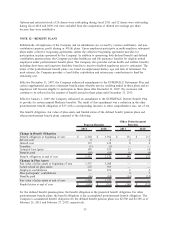

The following table reflects the calculation of basic and diluted net earnings (loss) per share:

2011 2010 2009

Net earnings (loss) per share—basic:

Net earnings (loss) $ (1,510) $ 393 $ (2,855)

Deduct: undistributed net earnings allocable to contingently

convertible debentures — — —

Net earnings (loss) available to common stockholders $ (1,510) $ 393 $ (2,855)

Weighted average shares outstanding—basic 212 212 211

Net earnings (loss) per share—basic $ (7.13) $ 1.86 $ (13.51)

Net earnings (loss) per share—diluted:

Net earnings (loss) $ (1,510) $ 393 $ (2,855)

Interest related to dilutive contingently convertible debentures, net

of tax — 1 —

Net earnings (loss) used for diluted net earnings per share

calculation $ (1,510) $ 394 $ (2,855)

Weighted average shares outstanding—basic 212 212 211

Dilutive impact of options and restricted stock outstanding — 1 —

Dilutive impact of convertible securities — — —

Weighted average shares outstanding—diluted 212 213 211

Net earnings (loss) per share—diluted $ (7.13) $ 1.85 $ (13.51)

54