Albertsons 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

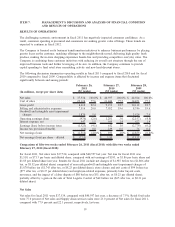

ITEM 6. SELECTED FINANCIAL DATA

(Dollars and shares in millions, except per

share data)

2011

(52 weeks)

2010

(52 weeks)

2009

(53 weeks)

2008

(52 weeks)

2007

(1)

(52 weeks)

Operating Results

Net sales $ 37,534 $ 40,597 $ 44,564 $ 44,048 $ 37,406

Identical store retail sales increase

(decrease)

(2)

(6.0)% (5.1)% (1.2)% 0.5% 0.4%

Cost of sales 29,124 31,444 34,451 33,943 29,267

Selling and administrative expenses 7,516 7,952 8,746 8,421 6,834

Goodwill and intangible asset impairment

charges

(3)

1,870 — 3,524 — —

Operating earnings (loss) (976) 1,201 (2,157) 1,684 1,305

Interest expense, net 547 569 622 707 558

Earnings (loss) before income taxes (1,523) 632 (2,779) 977 747

Income tax provision (benefit) (13) 239 76 384 295

Net earnings (loss) (1,510) 393 (2,855) 593 452

Net earnings (loss) as a percent of net sales (4.02)% 0.97% (6.41)% 1.35% 1.21%

Net earnings (loss) per share—diluted (7.13) 1.85 (13.51) 2.76 2.32

Financial Position

Inventories (FIFO)

(4)

$ 2,552 $ 2,606 $ 2,967 $ 2,956 $ 2,927

Working capital

(4)

(84) (192) (109) (280) (67)

Property, plant and equipment, net 6,604 7,026 7,528 7,533 8,415

Total assets 13,758 16,436 17,604 21,062 21,702

Debt and capital lease obligations 6,751 7,635 8,484 8,833 9,478

Stockholders’ equity 1,340 2,887 2,581 5,953 5,306

Other Statistics

Return on average stockholders’ equity (76.36)% 14.42% (59.32)% 10.44% 9.61%

Book value per share $ 6.32 $ 13.62 $ 12.19 $ 28.13 $ 25.40

Current ratio

(4)

0.98:1 0.95:1 0.98:1 0.94:1 0.99:1

Debt to capital ratio

(5)

83.4% 72.6% 76.7% 59.7% 64.1%

Dividends declared per share $ 0.3500 $ 0.6100 $ 0.6875 $ 0.6750 $ 0.6575

Weighted average shares

outstanding—diluted 212 213 211 215 196

Depreciation and amortization $ 925 $ 957 $ 1,057 $ 1,017 $ 879

Capital expenditures

(6)

$ 604 $ 691 $ 1,212 $ 1,227 $ 910

Retail stores as of fiscal year end

(7)

2,394 2,349 2,421 2,474 2,478

(1) Fiscal 2007 includes 38 weeks of operating results of the Acquired Operations as well as the assets and

liabilities of the Acquired Operations as of the end of fiscal 2007.

(2) The change in identical store sales is calculated as the change in net sales for stores operating for four

full quarters, including store expansions and excluding fuel and planned store dispositions. Fiscal 2008

and 2007 identical store sales is calculated as if the Acquired Operations stores were in the identical

store base for four full quarters in fiscal 2008, 2007 and 2006.

(3) The Company recorded goodwill and intangible asset impairment charges of $1,870 before tax ($1,743

after tax, or $8.23 per diluted share) in fiscal 2011 and $3,524 before tax ($3,326 after tax, or $15.71 per

diluted share) in fiscal 2009.

(4) Inventories (FIFO), working capital and current ratio are calculated after adding back the LIFO reserve.

The LIFO reserve for each year is as follows: $282 for fiscal 2011, $264 for fiscal 2010, $258 for fiscal

2009, $180 for fiscal 2008 and $178 for fiscal 2007.

(5) The debt to capital ratio is calculated as debt and capital lease obligations divided by the sum of debt

and capital lease obligations and stockholders’ equity. The increases in fiscal 2011 and fiscal 2009 are

due to the write-down of goodwill and intangible assets.

(6) Capital expenditures include fixed asset and capital lease additions.

(7) Retail stores as of fiscal year end includes licensed hard-discount food stores and is adjusted for planned

sales and closures as of the end of each fiscal year.

Historical data is not necessarily indicative of the Company’s future results of operations or financial

condition. See discussion of “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

18