Albertsons 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

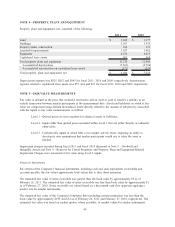

NOTE 7—LEASES

The Company leases certain retail stores, distribution centers, office facilities and equipment from third

parties. Many of these leases include renewal options and, to a limited extent, include options to purchase.

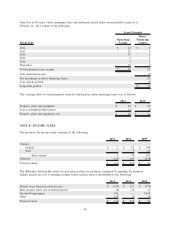

Future minimum lease payments to be made by the Company for noncancellable operating leases and capital

leases as of February 26, 2011 consist of the following:

Fiscal Year

Operating

Leases

Capital

Leases

Lease Obligations

2012 $ 382 $ 151

2013 354 149

2014 320 146

2015 288 143

2016 254 139

Thereafter 1,513 1,186

Total future minimum obligations $ 3,111 1,914

Less interest (760)

Present value of net future minimum obligations 1,154

Less current obligations (66)

Long-term obligations $ 1,088

Total future minimum obligations have not been reduced for future minimum subtenant rentals of $295 under

certain operating subleases.

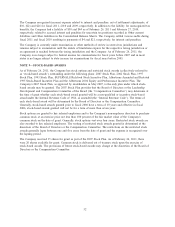

Rent expense and subtenant rentals under operating leases consisted of the following:

2011 2010 2009

Minimum rent $ 435 $ 455 $ 460

Contingent rent 5 6 8

440 461 468

Subtenant rentals (66) (66) (67)

$ 374 $ 395 $ 401

The Company leases certain property to third parties under both operating and direct financing leases. Under

the direct financing leases, the Company leases buildings to independent retail customers with terms ranging

49