Albertsons 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

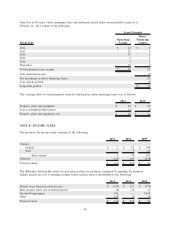

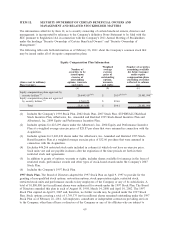

The asset allocation guidelines and the actual allocation of pension plan assets are as follows:

Asset Category Target 2011 2010

Domestic equity 31.8% 35.5% 42.3%

International equity 15.7% 18.0% 21.6%

Private equity 7.5% 3.5% 2.2%

Fixed income 35.0% 35.6% 33.7%

Real estate 10.0% 7.3% -

Cash and other - 0.1% 0.2%

Total 100.0% 100.0% 100.0%

The following is a description of the valuation methodologies used for investments measured at fair value:

Common stock— Valued at the closing price reported in the active market in which the individual securities

are traded.

Common collective trusts—Valued at Net Asset Value (“NAV”), which is based on the value of the underlying

securities owned by the fund and divided by the number of shares outstanding.

Corporate bonds— Valued based on yields currently available on comparable securities of issuers with similar

credit ratings.

Government securities— Certain government securities are valued at the closing price reported in the active

market in which the security is traded. Other government securities are valued based on yields currently

available on comparable securities of issuers with similar credit ratings.

Mortgage-backed securities— Valued based on yields currently available on comparable securities of issuers

with similar credit ratings.

Private equity— Valued using closing prices of comparable securities with similar terms or valued at NAV,

which is based on the value of the underlying securities owned by the fund and divided by the number of

shares outstanding.

Mutual funds— Certain mutual funds are valued at the closing price reported in the active market in which

the individual securities are traded. Other mutual funds are valued at NAV, which is based on the value of the

underlying securities owned by the fund and divided by the number of shares outstanding.

Other—Valued under an approach that maximizes observable inputs, such as gathering consensus data from

the market participant’s best estimate of mid-market for actual trades or positions held.

The valuation methods described above may produce a fair value calculation that may not be indicative of net

realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuations methods are

appropriate and consistent with other market participants, the use of different methodologies or assumptions to

determine the fair value of certain financial instruments could result in a different fair value measurement.

59