Albertsons 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

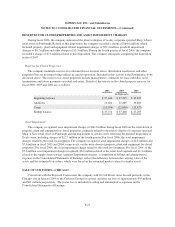

Temporary differences which give rise to significant portions of the net deferred tax asset (liability) as of

February 25, 2006 and February 26, 2005 are as follows:

2006 2005

(In thousands)

Deferred tax assets:

Restructure $ 31,558 $ 25,845

Net operating loss from acquired subsidiaries 14,546 16,191

Pension liability 52,756 41,580

Other health and benefit plans 123,173 92,054

Other 7,114 13,117

Total deferred tax assets 229,147 188,787

Deferred tax liabilities:

Accelerated deductions primarily depreciation and

amortization (166,088) (218,442)

Acquired assets basis differences (72,012) (52,220)

Accelerated interest deductions (15,760) (11,293)

Other (3,025) (24,769)

Total deferred tax liabilities (256,885) (306,724)

Net deferred tax liability $ (27,738) $(117,937)

The company currently has net operating loss (NOL) carryforwards from acquired companies of $40 million

for tax purposes, which expire beginning in 2007 and continuing through 2018.

Based on management’s assessment, it is more likely than not that all of the deferred tax assets will be

realized; therefore, no valuation allowance is considered necessary.

ACCUMULATED OTHER COMPREHENSIVE LOSSES

The accumulated balances, net of income taxes, for each classification of accumulated other comprehensive

losses are as follows:

Minimum Pension

Liability Adjustment

Accumulated Other

Comprehensive Losses

(In thousands)

Balances at February 28, 2004 $ (98,732) $ (98,732)

Minimum pension liability (5,849) (5,849)

Balances at February 26, 2005 (104,581) (104,581)

Minimum pension liability (23,646) (23,646)

Balances at February 25, 2006 $(128,227) $(128,227)

F-29