Albertsons 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

RESERVES FOR CLOSED PROPERTIES AND ASSET IMPAIRMENT CHARGES

During fiscal 2006, the company announced the plans to dispose of twenty corporate operated Shop ‘n Save

retail stores in Pittsburgh. Related to this disposition, the company recorded a charge of $64.6 million, which

included property, plant and equipment related impairment charges of $52.4 million, goodwill impairment

charges of $6.7 million and other charges of $5.5 million. During the fourth quarter of fiscal 2006, the company

recorded a charge of $7.3 million related to this disposition. The company anticipates completing the disposition

in fiscal 2007.

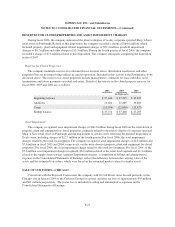

Reserves for Closed Properties:

The company maintains reserves for estimated losses on retail stores, distribution warehouses and other

properties that are no longer being utilized in current operations. Included in this activity is the Pittsburgh activity

discussed above. The reserves for closed properties include management’s estimates for lease subsidies, lease

terminations and future payments on exited real estate. Details of the activity in the closed property reserves for

fiscal 2006, 2005 and 2004 are as follows:

2006 2005 2004

(in thousands)

Beginning balance $ 37,446 $ 47,205 $ 49,873

Additions 10,404 12,889 10,809

Usage (10,076) (22,648) (13,477)

Ending balance $ 37,774 $ 37,446 $ 47,205

Asset Impairment:

The company recognized asset impairment charges of $66.5 million during fiscal 2006 on the write-down of

property, plant and equipment for closed properties, primarily related to the plan to dispose of corporate operated

Shop ‘n Save retail stores in Pittsburgh and the impairment of certain assets following the planned disposition of

Deals stores, including charges of $12.7 million in the fourth quarter. For fiscal 2006, the asset impairment

charges related to the retail food segment. The company recognized asset impairment charges of $4.8 million and

$7.6 million in fiscal 2005 and 2004, respectively, on the write-down of property, plant and equipment for closed

properties. For fiscal 2005, the asset impairment charge related to the retail food segment. For fiscal 2004, of the

$7.6 million asset impairment charge recognized, $6.2 million related to the retail food segment and $1.4 million

related to the supply chain services segment. Impairment charges, a component of selling and administrative

expenses in the Consolidated Statements of Earnings, reflect the difference between the carrying value of the

assets and the estimated fair values, which were based on the estimated market values for similar assets.

SALE OF CUB FOODS—CHICAGO

Concurrent with the Proposed Transaction, the company sold 26 Cub Foods stores located primarily in the

Chicago area in January 2006 to the Cerberus Group for a pretax and after tax loss of approximately $95 million

and $61 million, respectively. The pretax loss is included in selling and administrative expenses on the

Consolidated Statements of Earnings.

F-21