Albertsons 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) The company’s purchase obligations include various obligations that have annual purchase commitments of

$1 million or greater. At the end of fiscal 2006, future purchase obligations of approximately $40 million

existed that primarily related to technology and advertising. In the ordinary course of business, the company

enters into supply contracts to purchase products for resale. These supply contracts typically include either a

volume commitment or a fixed expiration date, termination provisions and other standard contractual

considerations. These supply contracts are cancelable and therefore no amounts have been included above.

In addition, see the Subsequent Event footnote for additional discussion of the Proposed Transaction.

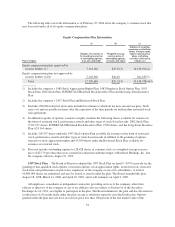

COMMON STOCK PRICE

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal

2006 year end, there were 6,206 shareholders of record compared with 6,483 at the end of fiscal 2005.

Common Stock Price Range Dividends Per Share

2006 2005 2006 2005

Fiscal High Low High Low

First Quarter $34.72 $30.64 $32.49 $27.25 $0.1525 $0.1450

Second Quarter 35.88 30.90 31.99 25.70 0.1625 0.1525

Third Quarter 33.93 29.55 32.59 26.59 0.1625 0.1525

Fourth Quarter 34.75 30.60 35.15 31.30 0.1625 0.1525

Year 35.88 29.55 35.15 25.70 0.6400 0.6025

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to

the Board of Directors approval.

NEW ACCOUNTING STANDARDS

In December 2004, the Financial Accounting Standards Board (“FASB”) issued FASB Statement 123

(Revised 2004), “Share-Based Payment.” This revised statement, which is effective for fiscal years beginning

after June 15, 2005, requires all share-based payments to employees to be recognized in the financial statements

based on their fair values. The company currently accounts for its share-based payments to employees under the

intrinsic value method of accounting set forth in Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issues to Employees.” Additionally, the company complies with the stock-based employer compensation

disclosure requirements of SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and

Disclosure, an amendment of FASB Statement No. 123.” The company plans to adopt the revised statement in its

first quarter of its fiscal year 2007, which begins on February 26, 2006. For previously issued awards, the

company will adopt SFAS 123(R) on a modified prospective basis and recognize compensation expense on the

unvested portion of the awards over the remaining vesting period. The company estimates that earnings per share

for the year ending February 24, 2007 will be reduced by approximately $0.10 per diluted share as a result of the

incremental compensation expense to be recognized from implementing SFAS No. 123(R). These estimates will

change if the company completes the Proposed Transaction, as described above.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets, an amendment of

APB Opinion No. 29” (“SFAS 153”). SFAS 153 amends Opinion 29 to eliminate the exception for nonmonetary

exchanges of similar productive assets and replaces it with a general exception for exchanges of nonmonetary

assets that do not have commercial substance. A nonmonetary exchange has commercial substance if the future

cash flows of the entity are expected to change significantly as a result of the exchange. The company is required

to adopt the provisions of SFAS 153 during the first quarter of fiscal year 2007, which begins on February 26,

2006. The provisions of SFAS 153 are not expected to have a material impact on the consolidated financial

statements.

27