Albertsons 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The company is party to a synthetic leasing program for one of its major warehouses. The lease qualifies for

operating lease accounting treatment under SFAS No. 13, “Accounting for Leases.” For additional information

on the synthetic lease, refer to the Commitments, Contingencies and Off-Balance Sheet Arrangements note in the

Notes to Consolidated Financial Statements.

Total rent expense, net of sublease income, relating to all operating leases with terms greater than one year

was $121.9 million, $115.6 million and $119.7 million in fiscal 2006, 2005 and 2004, respectively.

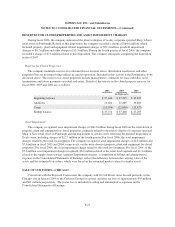

Future minimum receivables under operating leases and subleases in effect at February 26, 2005 are as

follows:

Owned

Property

Leased

Property Total

(In thousands)

Fiscal Year

2007 $1,026 $21,974 $ 23,000

2008 1,016 17,588 18,604

2009 513 13,887 14,400

2010 246 10,556 10,802

2011 81 7,120 7,201

Later — 26,367 26,367

Total future minimum receivables $2,882 $97,492 $100,374

Owned property leased to third parties is as follows:

February 25,

2006

February 26,

2005

(In thousands)

Land, buildings and equipment $11,782 $10,055

Less accumulated depreciation 7,285 5,566

Net land, buildings and equipment $ 4,497 $ 4,489

F-27