Albertsons 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

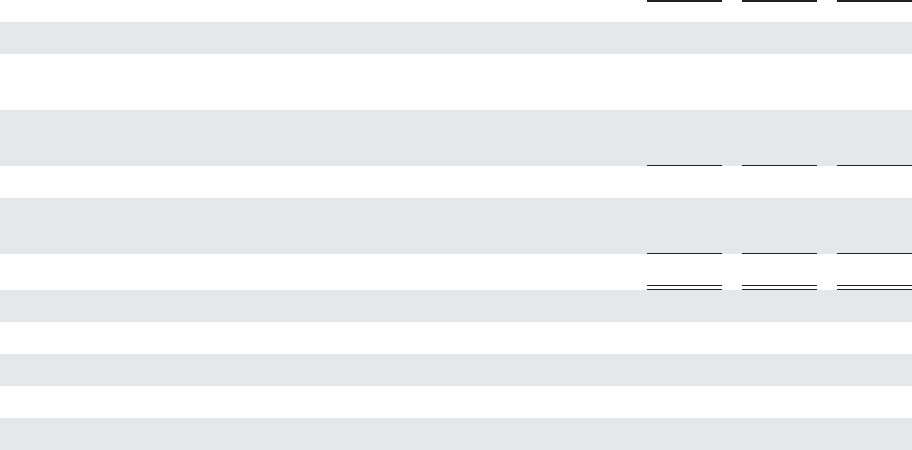

The following table illustrates the effect on net earnings and net earnings per share if the company had

applied the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation,” as

amended by SFAS No. 148, “Accounting for Stock-Based Compensation,” to stock-based employee

compensation:

2006 2005 2004

(In thousands, except per share data)

Net earnings, as reported $206,169 $385,823 $280,138

Add: stock-based compensation expense included in reported net earnings,

net of related tax effect 1,849 7,732 1,385

Deduct: total stock-based employee compensation expense determined under

fair value based method for all awards, net of related tax effect (17,892) (23,733) (11,643)

Pro forma net earnings 190,126 369,822 269,880

Add: interest and amortization on dilutive convertible debentures, net of

related tax effect 7,070 6,786 7,678

Pro forma net earnings for diluted earnings per share $197,196 $376,608 $277,558

Earnings per share—basic:

As reported $ 1.52 $ 2.86 $ 2.09

Pro forma $ 1.40 $ 2.74 $ 2.01

Earnings per share—diluted:

As reported $ 1.46 $ 2.71 $ 2.01

Pro forma $ 1.36 $ 2.60 $ 1.93

For more information on the method and assumptions used in determining the fair value of stock-based

compensation, see the Stock Option Plans note in the Notes to Consolidated Financial Statements.

Income Taxes:

The company provides for deferred income taxes during the year in accordance with SFAS No. 109,

“Accounting for Income Taxes”. Deferred income taxes represent future net tax effects resulting from temporary

differences between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect

for the year in which the differences are expected to be settled or realized. The major temporary differences and

their net effect are included in the Income Taxes note in the Notes to Consolidated Financial Statements.

Net Earnings Per Share (EPS):

Basic EPS is calculated using income available to common shareholders divided by the weighted average

number of common shares outstanding during the year. Diluted EPS is similar to basic EPS except that the

weighted average number of common shares outstanding is after giving affect to the dilutive impacts, if any, of

stock options, restricted stock, and outstanding contingently convertible debentures. In addition, for the

calculation of diluted earnings per share, net income is adjusted to eliminate the after tax interest expense

recognized during the year related to contingently convertible debentures, when the contingently convertible

debentures are dilutive. See the Earnings Per Share note in the Notes to Consolidated Financial Statements.

F-18