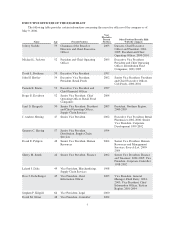

Albertsons 2006 Annual Report Download - page 17

Download and view the complete annual report

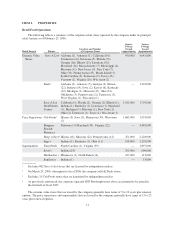

Please find page 17 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2006 store activity, including licensed units, resulted in 68 new stores opened and 85 stores closed.

Exclusive of the Chicago, Pittsburgh and Deals stores, total retail square footage, including licensed stores,

increased approximately two percent over the prior year.

Supply chain services sales for fiscal 2006 were $9.2 billion compared with $9.0 billion last year, an

increase of $0.2 billion or 2.6 percent compared with last year, primarily reflecting new business from the

traditional food distribution business, the recent acquisition of Total Logistics and temporary new business of

approximately three percent, three percent and two percent, respectively, partially offset by customer attrition,

which includes the fiscal 2006 impact of cycling three large customer transitions to other suppliers in the prior

year.

Gross Profit

Gross profit (calculated as net sales less cost of sales), as a percent of net sales, was 14.5 percent for fiscal

2006 compared with 14.6 percent last year. Gross profit as a percent of net sales primarily reflects the benefits of

retail merchandising execution and the acquisition of Total Logistics, a higher margin third party logistics

business, which was more than offset by the impact of supply chain costs of approximately $22 million related to

costs for new growth initiatives for supply chain technology and the launch of our specialty produce distribution

business, W. Newell and Co. (“growth initiatives”) and approximately $0.6 million of losses related to minority

owned investments in contrast to $14.3 million of earnings in fiscal 2005.

Selling and Administrative Expenses

Selling and administrative expenses, as a percentage of net sales, were 12.3 percent for fiscal 2006

compared with 11.4 percent last year. The increase primarily reflects approximately $174 million of pre-tax costs

related to charges for Chicago, Pittsburgh, Deals and the Hurricane.

Restructure and Other Charges

For fiscal 2006 and fiscal 2005, the company incurred $4.5 million and $26.4 million, respectively, in

pre-tax restructure and other charges. These charges primarily reflect changes in estimates on exited real estate

for fiscal 2006 and the increased liabilities associated with employee benefits related costs from previously

exited distribution facilities as well as changes in estimates on exited real estate for fiscal 2005.

Operating Earnings

Operating earnings for fiscal 2006 were $435.2 million compared with $715.6 million last year. Results for

fiscal 2006 include charges of approximately $174 million pre-tax related to Chicago, Pittsburgh, Deals and the

Hurricane and $4.5 million of restructuring and other charges. Fiscal 2005 includes a pre-tax gain of

approximately $109 million pre-tax gain on the sale of WinCo and $26.4 million of restructure and other charges.

Retail food fiscal 2006 operating earnings were $268.8 million, or 2.5 percent of net sales, compared to last

year’s operating earnings of $446.3 million, or 4.2 percent of net sales. The decrease in retail food operating

earnings, as a percent of net sales, primarily reflects charges of approximately $174 million pre-tax related to

Chicago, Pittsburgh, Deals and the Hurricane. Supply chain services fiscal 2006 operating earnings were $214.4

million, or 2.3 percent of net sales compared to last year’s operating earnings of $234.6 million, or 2.6 percent of

sales. The decrease in supply chain services operating earnings, as a percent of net sales, primarily reflects the

start-up costs related to growth initiatives and losses from minority owned investments, which more than offset

the benefit of the higher margin third party logistics business acquired in February 2005.

Net Interest Expense

Net interest expense decreased to $106.0 million for fiscal 2006 compared with $114.8 million last year.

The decrease primarily reflects lower borrowing levels partially offset by higher borrowing rates and the absence

of the $5.7 million early redemption costs relating to the $250 million notes redeemed in the first quarter of fiscal

2005.

17