Albertsons 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the company’s common stock on the New York Stock Exchange for twenty of the last thirty trading days of any

fiscal quarter exceeds certain levels, at $39.75 per share for the quarter ending June 17, 2006, and rising to

$113.29 per share at September 6, 2031, if the rating assigned to the debentures by Standard & Poor’s rating

service or Moody’s rating service, are “BB” or lower, or Ba3 or lower, respectively, if the notes are called for

redemption, or if certain specified corporate actions occur. See Subsequent Events note. In the event of

conversion, 9.6434 shares of the company’s common stock will be issued per $1,000 debenture or approximately

7.8 million shares should all debentures be converted. The debentures have an initial yield to maturity of 4.5

percent, which is being accreted over the life of the debentures using the effective interest method. The company

will pay contingent cash interest for the six-month period commencing November 3, 2006 and for any six-month

period thereafter if the average market price of the debentures for a five trading day measurement period

preceding the applicable six-month period equals 120 percent or more of the sum of the issue price and accrued

original issue discount for the debentures. The debentures are classified as long-term debt based on the

company’s intent, subject to the Proposed Transaction, to settle with equity shares upon conversion.

The debt agreements contain various financial covenants including ratios for interest coverage and debt

leverage as defined in the company’s debt agreements. The company has met the financial covenants under the

debt agreements as of February 25, 2006.

The company is party to a synthetic leasing program for one of its major warehouses. The lease expires

April 2008, may be renewed with the lessor’s consent through April 2013 and has a purchase option of

approximately $60 million.

In connection with the Proposed Transaction, the Royal Bank of Scotland plc has committed to provide the

company with senior credit facilities in the amount of $4 billion (the “Facilities”). These Facilities, which will

replace the $750 million credit facility described above, consist of a $2 billion five year Revolving Credit

Facility, a $1.25 billion five year Term Loan A and a $750 million six year Term Loan B. Rates on the Facilities

are tied to LIBOR plus 0.50 to 1.875 percent and with facility fees ranging from 0.10 to 0.50 percent, both based

on the company’s credit rating. The Facilities are guaranteed by certain material subsidiaries of the company and

the stock of such subsidiaries is pledged as security for such guarantees. The Facilities also include various

covenants and restrictions customary for senior secured credit facilities, including ratios for interest coverage and

debt leverage. The company expects to have approximately $2 billion drawn on the Facilities simultaneous with

the closing of the Proposed Transaction.

Management expects that the company will continue to replenish operating assets with internally generated

funds. There can be no assurance, however, that the company’s business will continue to generate cash flow at

current levels. The company will continue to obtain short-term financing from its revolving credit agreement

with various financial institutions, as well as through its accounts receivable securitization program. Long-term

financing will be maintained through existing and new debt issuances. The company’s short-term and long-term

financing abilities are believed to be adequate as a supplement to internally generated cash flows to fund its

capital expenditures and acquisitions as opportunities arise. Maturities of debt issued will depend on

management’s views with respect to the relative attractiveness of interest rates at the time of issuance and other

debt maturities.

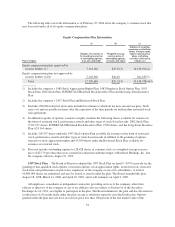

The company repurchases shares of the company’s common stock under programs authorized by the Board

of Directors, for re-issuance upon the exercise of employee stock options and for other compensation programs

utilizing the company’s stock. The company repurchased 0.9 million, 2.0 million and 0.6 million shares of

common stock at an average cost per share of $32.19, $28.30 and $23.80 during fiscal 2006, 2005 and 2004,

respectively. As of February 25, 2006, approximately 3.7 million shares remained available for purchase under

the 5.0 million share repurchase program authorized by the Board of Directors in May 2004.

SFAS No. 87, “Employers’ Accounting for Pension,” requires that a prepaid pension asset or minimum

pension liability, based on the current market value of plan assets and the accumulated benefit obligation of the

24