Albertsons 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

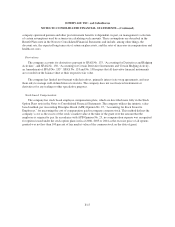

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except per share data)

Common Stock Capital in

Excess of

Par Value

Treasury Stock

Accumulated

Other

Comprehensive

Losses

Retained

Earnings TotalShares Amount Shares Amount

BALANCES AT FEBRUARY 24,

2003 150,670 $150,670 $114,028 (16,982) $(327,327) $ (79,063) $2,150,932 $2,009,240

Net earnings — — — — — — 280,138 280,138

Other comprehensive loss — — — — — (19,669) — (19,669)

Sales of common stock under option

plans — — (11,047) 1,596 41,508 — — 30,461

Cash dividends declared on common

stock $0.5775 per share — — — — — — (77,495) (77,495)

Compensation under employee

incentive plans — — (629) 93 2,127 — — 1,498

Purchase of shares for treasury — — — (617) (14,599) — — (14,599)

BALANCES AT FEBRUARY 28,

2004 150,670 150,670 102,352 (15,910) (298,291) (98,732) 2,353,575 2,209,574

Net earnings — — — — — — 385,823 385,823

Other comprehensive loss — — — — — (5,849) — (5,849)

Sales of common stock under option

plans — — 12,522 2,646 44,143 — — 56,665

Cash dividends declared on common

stock $0.6025 per share — — — — — — (81,386) (81,386)

Compensation under employee

incentive plans — — 1,173 49 520 — — 1,693

Purchase of shares for treasury — — — (1,977) (55,959) — — (55,959)

BALANCES AT FEBRUARY 26,

2005 150,670 150,670 116,047 (15,192) (309,587) (104,581) 2,658,012 2,510,561

Net earnings — — — — — — 206,169 206,169

Other comprehensive loss — — — — — (23,646) — (23,646)

Sales of common stock under option

plans — — 14,079 1,670 22,429 — — 36,508

Cash dividends declared on common

stock $0.6400 per share — — — — — — (87,285) (87,285)

Compensation under employee

incentive plans — — 2,591 184 3,367 — — 5,958

Purchase of shares for treasury — — — (895) (28,812) — — (28,812)

BALANCES AT FEBRUARY 25,

2006 150,670 $150,670 $132,717 (14,233) $(312,603) $(128,227) $2,776,896 $2,619,453

2006 2005 2004

Comprehensive income:

Net earnings $206,169 $385,823 $280,138

Derivative financial instrument—unrealized loss, net of tax of $4.2 million in 2004 — — 6,735

Minimum pension liability, net of tax of $16.1 million in 2006, $(2.5) million in 2005 and $17.1

million in 2004 (23,646) (5,849) (26,404)

Comprehensive income $182,523 $379,974 $260,469

See Notes to Consolidated Financial Statements.

F-10