Albertsons 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results for fiscal 2005 include a net after-tax gain on the sale of the company’s minority interest in WinCo of

$68.3 million or $0.51 basic earnings per share and $0.47 diluted earnings per share.

Weighted average basic shares increased to 135.0 million in fiscal 2005 compared to 134.0 million in fiscal

2004 and weighted average diluted shares increased to 144.9 million in fiscal 2005 compared with 143.2 million

shares in fiscal 2004, reflecting the net impact of stock option activity and shares repurchased under the treasury

stock program.

RESTRUCTURE AND OTHER CHARGES

In fiscal 2002, 2001 and 2000, the company commenced restructuring programs designed to reduce costs

and enhance efficiencies and included facility consolidation and disposal of non-core assets and assets not

meeting return objectives or providing long-term strategic opportunities. The restructuring plans resulted in the

company recording pre-tax restructure and other charges in fiscal 2002, 2001 and 2000.

In fiscal 2003, all activity for the fiscal 2002, 2001 and 2000 restructure plans was completed. The company

recognized pre-tax restructure and other charges of $4.5 million, $26.4 million and $15.5 million for fiscal years

2006, 2005 and 2004 respectively. These charges reflect changes in liabilities associated with employee benefit

related costs from previously exited distribution facilities as well as changes in estimates on exited real estate,

including asset impairment. Fiscal 2006 charges related primarily to restructure 2001 and consisted of

adjustments for changes in estimates on exited real estate of $1.4 million, asset impairment charges of $1.0

million and property holding costs of $2.1 million. Fiscal 2005 charges related primarily to restructure 2001 and

consisted of adjustments of $22.3 million for changes in estimates, asset impairment charges of $0.5 million, and

property holding costs of $3.6 million. Fiscal 2004 charges reflect the net adjustments to the restructure reserves

of $12.8 million, as well as asset impairment adjustments of $2.7 million for restructure 2001.

The remaining 2001 restructure reserves include $12.4 million for employee benefit related costs and $12.3

million for lease related costs for exited properties.

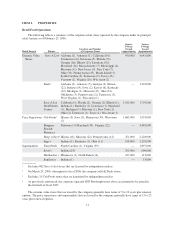

The table below shows the remaining restructure reserves for the 2002, 2001 and 2000 plans as of

February 25, 2006, as well as reserve related activity for the three fiscal years then ended.

Restructure

Plan

Fiscal 2003

Reserve

Balance

Fiscal 2004

Activity Fiscal 2004

Reserve

Balance

Fiscal 2005

Activity Fiscal 2005

Reserve

Balance

Fiscal 2006

Activity Fiscal 2006

Reserve

BalanceUsage Adjustment Usage Adjustment Usage Adjustment

(In millions)

2002 $ 3.4 $ (3.8) $ 0.6 $ 0.2 $(0.2) $ — $ — $ — $ — $ —

2001 $32.2 $(17.3) $11.7 $26.6 $(6.6) $22.3 $42.3 $(18.7) $1.1 $24.7

2000 $11.1 $ (9.1) $ 0.5 $ 2.5 $(1.4) $ — $ 1.1 $ (1.4) $0.3 $ —

CRITICAL ACCOUNTING POLICIES

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Significant accounting policies are discussed in the Summary of Significant Accounting Policies in the

accompanying Notes to Consolidated Financial Statements. Management believes the following critical

accounting policies reflect its more subjective or complex judgments and estimates used in the preparation of the

company’s consolidated financial statements.

20