Albertsons 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTES RECEIVABLE

Notes receivable arise from financing activities with independent retail food customers. Loans to retailers,

as well as trade accounts receivable, are primarily collateralized by the retailers’ inventory, equipment and

fixtures. The notes range in length from one to seventeen years with an average term of six years, and may be

non-interest bearing or bear interest at rates ranging from approximately 4.5 to 10.7 percent.

Notes receivable, net due within one year of $18.0 million and $13.8 million at February 25, 2006 and

February 26, 2005, respectively, are included in current receivables, net in the Consolidated Balance Sheets.

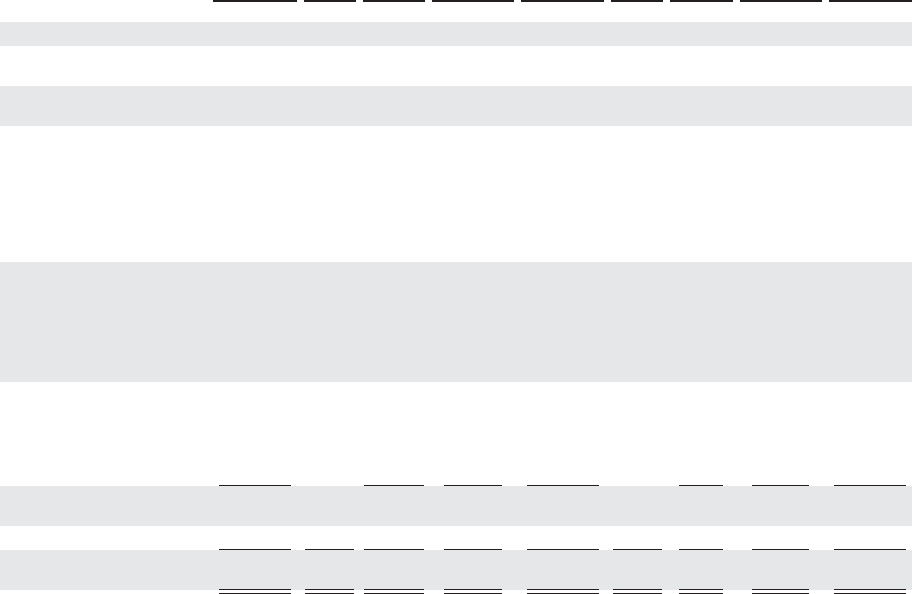

GOODWILL AND OTHER ACQUIRED INTANGIBLE ASSETS

On February 7, 2005, the company acquired Total Logistics, a national provider of third party logistics

services for approximately $234 million comprised of $164 million of cash and $70 million of assumed debt. The

purchase price allocation resulted in approximately $14.7 million of intangible assets related to trademarks,

tradenames and customer relationships and approximately $116.6 million of goodwill.

At February 25, 2006 and at February 26, 2005, the company had approximately $0.8 billion of goodwill

related to retail food and $0.8 billion related to supply chain services.

A summary of changes in the company’s goodwill and other acquired intangible assets during fiscal 2006

and fiscal 2005 follows:

February 28,

2004

Amorti-

zation Additions

Other net

adjustments

February 26,

2005

Amorti-

zation Additions

Other net

adjustments

February 25,

2006

(in thousands)

Goodwill $1,557,057 $116,606 $(45,816) $1,627,847 $6,454 $(20,698) $1,613,603

Other acquired intangible

assets:

Trademarks and

tradenames 15,269 8,042 (1,057) 22,254 236 — 22,490

Leasehold Rights,

Customer lists and other

(accumulated

amortization of $23,704

and $20,573, at

February 25, 2006 and

February 26, 2005,

respectively) 49,369 510 (594) 49,285 589 (97) 49,777

Customer relationships

(accumulated

amortization of $5,220

and $2,492 at

February 25, 2006 and

February 26, 2005,

respectively) 43,361 6,700 (2,992) 47,069 564 — 47,633

Non-compete agreements

(accumulated

amortization of $5,105

and $4,329 at

February 25, 2006 and

February 26, 2005) 7,219 1,625 (550) 8,294 — — 8,294

Total other acquired intangible

assets 115,218 16,877 (5,193) 126,902 1,389 (97) 128,194

Accumulated amortization (22,290) $(6,166) — 1,062 (27,394) $(6,702) — 67 (34,029)

Total goodwill and other

acquired intangible assets, net $1,649,985 $(6,166) $133,483 $(49,947) $1,727,355 $(6,702) $7,843 $(20,728) $1,707,768

F-22