Albertsons 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

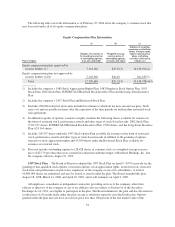

The table below provides information about the company’s financial instruments that are sensitive to

changes in interest rates, including notes receivable, debt obligations and interest rate swap agreements. For debt

obligations, the table presents principal cash flows and related weighted average interest rates by expected

maturity dates. For notes receivable, the table presents the expected collection of principal cash flows and

weighted average interest rates by expected maturity dates. For interest rate swap agreements, the table presents

the estimate of the differential between interest payable and interest receivable under the swap agreements

implied by the yield curve utilized to compute the fair value of the interest rate swaps.

Summary of Financial Instruments

February 25, 2006 Aggregate payments by fiscal year

Fair

Value Total 2007 2008 2009 2010 2011 Thereafter

(in millions, except rates)

Notes receivable

Principal receivable $ 50.9 $ 50.8 $18.0 $12.0 $7.5 $ 4.1 $2.2 $ 7.0

Average Rate receivable 7.5% 6.7% 8.8% 9.2% 9.5% 9.7% 3.8%

Debt with variable interest rates

Principal payable $ 53.9 $ 53.9 $ 3.0 $ 2.4 $7.2 $ 12.4 $0.4 $ 28.5

Average variable rate payable 3.4% 3.8% 3.9% 3.4% 3.4% 6.7% 3.3%

Debt with fixed interest rates

Principal payable $1,029.9 $994.1 $71.6 $ 4.7 $4.9 $353.9 $0.4 $558.6

Average fixed rate payable 6.8% 6.8% 8.1% 8.1% 7.9% 6.8% 6.0%

Fixed-to-variable interest rate swaps

Amount receivable $ 1.1 $ 1.1 $ 0.3 $ 0.3 $0.3 $ 0.2

Average variable rate payable 7.3%

Average fixed rate receivable 7.9%

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Securities Litigation Reform Act

Any statements contained in this report regarding the outlook for our businesses and their respective

markets, such as projections of future performance, statements of our plans and objectives, forecasts of market

trends and other matters, are forward-looking statements based on our assumptions and beliefs. Such statements

may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,”

“will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These

forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ

materially from those discussed in such statements and no assurance can be given that the results in any forward-

looking statement will be achieved. For these statements, the company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-

looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently

revise any forward-looking statement to reflect events or circumstances after such date or to reflect the

occurrence of anticipated or unanticipated events.

Certain factors could cause our future results to differ materially from those expressed or implied in any

forward-looking statements contained in this report. These factors include the factors discussed in Item 1A of this

report under the heading “Risk Factors,” the factors discussed below and any other cautionary statements, written

or oral, which may be made or referred to in connection with any such forward-looking statements. Since it not

possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

29