Albertsons 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

equaled the purchase option. The company’s obligation under its guaranty arrangements related to this synthetic

lease had a carrying balance of $0.4 million, which is reflected as a component of other liabilities in the

Consolidated Balance Sheet at February 25, 2006.

The company had $176.8 million of outstanding letters of credit as of February 25, 2006, of which $148.4

million were issued under the credit facility and $28.4 million were issued under separate agreements with

financial institutions. These letters of credit primarily support workers’ compensation, merchandise import

programs and payment obligations. The company pays fees, which vary by instrument, of up to 0.70 percent on

the outstanding balance of the letters of credit.

The company is a party to various legal proceedings arising from the normal course of business activities,

none of which, in management’s opinion, is expected to have a material adverse impact on the company’s

consolidated financial position.

The company is a party to a variety of contractual agreements under which the company may be obligated to

indemnify the other party for certain matters, which indemnities may be secured by operation of law or

otherwise, in the ordinary course of business. These contracts primarily relate to the company’s commercial

contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services to

the company, and agreements to indemnify officers, directors and employees in the performance of their work.

While the company’s aggregate indemnification obligation could result in a material liability, the company is

aware of no current matter that it expects to result in a material liability.

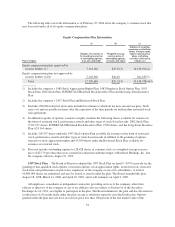

The following table represents the company’s significant contractual obligations and off-balance sheet

arrangements at February 25, 2006.

Amount of Commitment Expiration Per Period

Total

Amount

Committed

Fiscal

2007

Fiscal

2008-2009

Fiscal

2010-2011 Thereafter

(In thousands)

Contractual Obligations & Off-Balance

Sheet Arrangements:

Debt $1,049,110 $ 74,650 $ 19,151 $368,264 $ 587,045

Operating Leases 929,813 154,849 301,752 159,126 314,086

Interest on Long-Term Debt (1) 801,658 54,497 104,884 59,635 582,642

Capital and Direct Financing Leases 515,713 37,071 88,104 80,981 309,557

Benefit Obligations (2) 1,027,404 47,981 96,609 103,413 779,401

Construction Commitments 183,884 183,884 — — —

Retailer Loan and Lease Guarantees 226,330 27,248 45,724 34,552 118,806

Deferred Income Taxes 27,738 (18,697) 17,024 34,363 (4,952)

Purchase Option on Synthetic Lease 60,000 — 60,000 — —

Purchase Obligations (3) 39,998 30,410 9,588 — —

Total $4,861,648 $591,893 $742,836 $840,334 $2,686,585

(1) The interest on long-term debt for fiscal 2032 reflects the company’s zero-coupon debentures accreted

interest for fiscal 2007 through fiscal 2032, should the debentures remain outstanding to maturity.

(2) The company’s benefit obligations include obligations related to sponsored defined benefit pension and post

retirement benefit plans and deferred compensation plans. The defined benefit pension plan has plan assets

of approximately $556 million at the end of fiscal 2006.

26