Albertsons 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

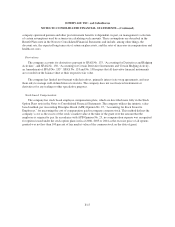

LEASES

Capital and operating leases:

The company leases certain retail food stores, food distribution warehouses and office facilities. Many of

these leases include renewal options, and to a limited extent, include options to purchase. Amortization of assets

under capital leases was $31.7 million, $34.5 million and $35.1 million in fiscal 2006, 2005 and 2004,

respectively. Accumulated amortization of assets under capital leases was $133.6 million and $144.9 million as

of February 25, 2006 and February 26, 2005, respectively.

Future minimum obligations under capital leases in effect at February 25, 2006 are as follows:

Lease

Obligations

(In thousands)

Fiscal Year

2007 $ 67,741

2008 67,240

2009 64,751

2010 62,658

2011 60,940

Later 464,767

Total future minimum obligations 788,097

Less interest 372,258

Present value of net future minimum obligations 415,839

Less current obligations 30,095

Long-term obligations $385,744

The present values of future minimum obligations shown are calculated based on interest rates determined

at the inception of the lease ranging from approximately 6 percent to 14 percent, with a weighted average rate of

7.8 percent.

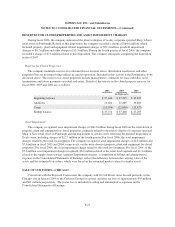

In addition to its capital leases, the company is obligated under operating leases, primarily for buildings,

warehouses and transportation and computer equipment. Future minimum obligations under operating leases in

effect at February 25, 2006 are as follows:

Operating

Lease

Obligations

(In thousands)

Fiscal Year

2007 $154,849

2008 134,069

2009 167,683

2010 86,971

2011 72,155

Later 314,086

Total future minimum obligations $929,813

F-26