Albertsons 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

application as the required method for reporting a change in accounting principle, unless impracticable or unless

a pronouncement includes alternative transition provisions. SFAS No. 154 also requires that a change in

depreciation, amortization or depletion method for long-lived, non-financial assets be accounted for as a change

in accounting estimate effected by a change in accounting principle. This statement carries forward the guidance

in APB Opinion No. 20, “Accounting Changes,” for the reporting of a correction of an error and a change in

accounting estimate. SFAS No. 154 is effective for the year beginning February 26, 2006.

In March 2005 the FASB issued FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement

Obligations—an Interpretation of FASB Statement No. 143” (“FIN 47”). FIN 47 clarifies that the term

“conditional asset retirement obligation” as used in FASB Statement No. 143, “Accounting for Asset Retirement

Obligations,” refers to a legal obligation to perform an asset retirement activity in which the timing and

(or) method of settlement are conditional on a future event that may or may not be within the control of the

entity. Accordingly, an entity is required to recognize a liability for the fair value of a conditional asset retirement

obligation if the fair value of the liability can be reasonably estimated. FIN 47 became effective for the company

during the fiscal year ended February 25, 2006 and did not have a material effect on the company’s consolidated

financial statements.

RESTRUCTURE AND OTHER CHARGES

In fiscal 2002, 2001 and 2000, the company commenced restructuring programs designed to reduce costs

and enhance efficiencies and included facility consolidation and disposal of non-core assets and assets not

meeting return objectives or providing long-term strategic opportunities. The restructuring plans resulted in the

company recording pre-tax restructure and other charges in fiscal 2002, 2001 and 2000.

In fiscal 2003, all activity for the fiscal 2002, 2001 and 2000 restructure plans was completed. The company

recognized pre-tax restructure and other charges of $4.5 million, $26.4 million and $15.5 million for fiscal years

2006, 2005 and 2004 respectively. These charges reflect changes in liabilities associated with employee benefit

related costs from previously exited distribution facilities as well as changes in estimates on exited real estate,

including asset impairment. Fiscal 2006 charges related primarily to restructure 2001 and consisted of

adjustments for changes in estimates on exited real estate of $1.4 million, asset impairment charges of $1.0

million and property holding costs of $2.1 million. Fiscal 2005 charges related primarily to restructure 2001 and

consisted of adjustments of $22.3 million for changes in estimates, asset impairment charges of $0.5 million, and

property holding costs of $3.6 million. Fiscal 2004 charges reflect the net adjustments to the restructure reserves

of $12.8 million, as well as asset impairment adjustments of $2.7 million for restructure 2001.

The remaining 2001 restructure reserves include $12.4 million for employee benefit related costs and $12.3

million for lease related costs for exited properties.

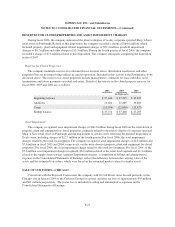

The table below shows the remaining restructure reserves for the 2002, 2001 and 2000 plans as of

February 25, 2006, as well as reserve related activity for the three fiscal years then ended.

Restructure

Plan

Fiscal 2003

Reserve

Balance

Fiscal 2004

Activity Fiscal 2004

Reserve

Balance

Fiscal 2005

Activity Fiscal 2005

Reserve

Balance

Fiscal 2006

Activity Fiscal 2006

Reserve

BalanceUsage Adjustment Usage Adjustment Usage Adjustment

(In millions)

2002 $ 3.4 $ (3.8) $ 0.6 $ 0.2 $(0.2) $ — $ — $ — $ — $ —

2001 $32.2 $(17.3) $11.7 $26.6 $(6.6) $22.3 $42.3 $(18.7) $1.1 $24.7

2000 $11.1 $ (9.1) $ 0.5 $ 2.5 $(1.4) $ — $ 1.1 $ (1.4) $0.3 $ —

F-20