Albertsons 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Allowances for Losses on Receivables

Management makes estimates of the uncollectibility of its accounts and notes receivable portfolios. In

determining the adequacy of the allowances, management analyzes the value of the collateral, customer financial

statements, historical collection experience, aging of receivables and other economic and industry factors.

Although risk management practices and methodologies are utilized to determine the adequacy of the allowance,

it is possible that the accuracy of the estimation process could be materially impacted by different judgments as

to collectibility based on the information considered and further deterioration of accounts.

LIFO and Retail Inventory Method

Inventories are stated at the lower of cost or market. Market is replacement value. Substantially all of the

company’s inventory is finished goods.

For a significant portion of the company’s inventory, cost is determined through use of the last-in, first-out

(LIFO) method. The company utilized LIFO to value approximately 65 percent and 64 percent of the company’s

consolidated inventories for fiscal 2006 and 2005, respectively.

The retail inventory method (“RIM”) is used to value retail inventory. The valuation of inventories is at cost

and the resulting gross margins are calculated by applying a calculated cost-to-retail ratio to the retail value of

inventories. RIM is an averaging method that has been widely used in the retail industry due to its practicality.

Inherent in the RIM calculations are certain significant management judgments and estimates, including

shrinkage, which significantly impact the ending inventory valuation at cost, as well as the resulting gross

margins. These judgments and estimates, coupled with the fact that the RIM is an averaging process, can, under

certain circumstances, produce results which differ from actual. Management believes that the company’s RIM

provides an inventory valuation which reasonably approximates cost and results in carrying inventory at the

lower of cost or market.

The company evaluates inventory shortages throughout the year based on actual physical counts in its

facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the financial statement date.

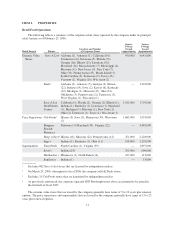

Reserves for Closed Properties and Asset Impairment Charges

The company maintains reserves for estimated losses on retail stores, distribution warehouses and other

properties that are no longer being utilized in current operations. The company provides for closed property lease

liabilities using a discount rate to calculate the present value of the remaining noncancellable lease payments

after the closing date, net of estimated subtenant income. The closed property lease liabilities usually are paid

over the remaining lease terms, which generally range from one to sixteen years. The company estimates

subtenant income and future cash flows based on the company’s experience and knowledge of the market in

which the closed property is located, the company’s previous efforts to dispose of similar assets and current

economic conditions.

Owned properties and capital lease properties that are closed are reduced to their estimated net realizable

value. Reduction in the carrying values of property, equipment and leasehold improvements are recognized when

expected net future cash flows are less than the assets’ carrying value. The company estimates net future cash

flows based on its experience and knowledge of the market in which the closed property is located and, when

necessary, utilizes local real estate brokers.

Adjustments to closed property reserves primarily relate to changes in subtenant income or actual exit costs

differing from original estimates. Adjustments are made for changes in estimates in the period in which the

changes become known.

21