Albertsons 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ÈANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 25, 2006

OR

‘TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the transition period from to

Commission file number: 1-5418

SUPERVALU INC.

(Exact name of registrant as specified in its charter)

Delaware 41-0617000

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

11840 Valley View Road

Eden Prairie, Minnesota 55344

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (952) 828-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $1.00 per share New York Stock Exchange

Preferred Share Purchase Rights New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ÈNo ‘

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ‘No È

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ÈNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will

not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K. ‘

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ÈAccelerated filer ‘Non-accelerated filer ‘

Indicate by check mark if the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ‘No È

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 10, 2005 was

approximately $4,238,283,124 (based upon the closing price of Registrant’s Common Stock on the New York Stock Exchange on

September 9, 2005.

Number of shares of $1.00 par value Common Stock outstanding as of May 1, 2006: 136,974,770.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s definitive Proxy Statement filed for the Registrant’s 2006 Annual Meeting of Stockholders are

incorporated by reference into Part III, as specifically set forth in Part III.

Table of contents

-

Page 1

... registered Common Stock, par value $1.00 per share New York Stock Exchange Preferred Share Purchase Rights New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of... -

Page 2

... fiscal year, the company conducted its retail operations through 1,381 stores, including 862 licensed extreme value stores. Store counts are adjusted for the planned sale of Deals and corporate owned Shop 'n Save Pittsburgh. SUPERVALU also provides supply chain services, including food distribution... -

Page 3

...: extreme value stores, regional price superstores and regional supermarkets. The retail operations include results of food stores owned and results of sales to extreme value stores licensed by the company. Supply chain services operations include results of sales to affiliated food stores, mass... -

Page 4

...food departments, and a variety of specialty departments that may include floral, seafood, expanded health and beauty care, video rental, cosmetics, delicatessen, bakery, photo finishing, liquor, as well as an in-store bank and a traditional drug store that includes a pharmacy. A typical supermarket... -

Page 5

... square footage to selling food (i.e. supercenters, supermarkets, extreme value stores, membership warehouse clubs, dollar stores, drug stores, convenience stores, various formats selling prepared foods, and other specialty and discount retailers), as well as from independent food store operators... -

Page 6

The traditional distribution component of the company's supply chain services business competes directly with a number of food wholesalers. The company believes it competes in this supply chain on the basis of product price, quality and assortment, schedule and reliability of deliveries, the range ... -

Page 7

... Food Companies Senior Vice President; President and Chief Operating Officer, Supply Chain Services Senior Vice President 1997 2002 Pamela K. Knous Roger E. Davidson 52 52 1997 2004 Janel S. Haugarth 50 2005 President, Northern Region, 2000-2005 Executive Vice President, Retail Pharmacies... -

Page 8

... Corporate Brands and Global Sourcing for Ahold USA, a food retailing company. Mr. Oliver was elected to his current position in April 2004. From November 1999 to April 2004, he was Chief Financial Officer, Arden Group, Inc., a holding company with supermarket operations in Southern California. ITEM... -

Page 9

... square footage to selling food (i.e. supercenters, supermarkets, extreme value stores, membership warehouse clubs, dollar stores, drug stores, convenience stores, various formats selling prepared foods, and other specialty and discount retailers), as well as from independent food store operators... -

Page 10

... labor disputes may affect sales at our stores as well as our ability to distribute products. We contribute to various multiemployer healthcare and pension plans covering certain unionrepresented employees in both our retail and distribution operations. A significant number of our employees (as well... -

Page 11

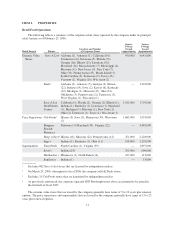

... 25, 2006: Square Square Footage Footage Owned Leased (Approximate) (Approximate) Retail Format Banner Location and Number of Corporate Stores Extreme Value Stores Save-A-Lot1 Alabama (1), Arkansas (1), California (16), Connecticut (6), Delaware (5), Florida (75), Georgia (16), Illinois (15... -

Page 12

...of the company's principal distribution centers and office space utilized in the company's supply chain services segment as of February 25, 2006: Square Footage Owned (Approximate) Square Footage Leased (Approximate) Region Location and Number of Distribution Centers Central Region Midwest Region... -

Page 13

... and supply chain services, which includes food distribution and related logistics support services. At February 25, 2006, we conducted our retail operations through a total of 1,381 stores of which 862 are licensed locations. Store counts are adjusted for the planned sale of Deals and Shop 'n Save... -

Page 14

... rising health care and pension costs. Although the rate of increase moderated in fiscal 2006, these rising costs impacted the overall profitability levels of the food industry and remain a pivotal issue in labor negotiations for unionized employees who bargain for health and retirement benefits in... -

Page 15

...low-cost supply chain and economies of scale as we leverage our retail and supply chain services operations. Save-A-Lot, our extreme value format, has nationwide potential, and currently operates in 39 states. We plan to expand regional retail banner square footage through selective new store growth... -

Page 16

... in February 2006 ("Deals") and approximately $3 million after-tax, or $0.02 per diluted share related to impact of Hurricane Katrina primarily at Save-A-Lot locations in Louisiana ("Hurricane"). Results for fiscal 2005 year-to-date include a net after-tax gain on the sale of the company's minority... -

Page 17

...units, resulted in 68 new stores opened and 85 stores closed. Exclusive of the Chicago, Pittsburgh and Deals stores, total retail square footage, including licensed stores, increased approximately two percent over the prior year. Supply chain services sales for fiscal 2006 were $9.2 billion compared... -

Page 18

...same store retail sales increased 0.3 percent. Fiscal 2005 store activity, including licensed units, resulted in 104 new stores opened and 38 stores closed, for a total of 1,549 stores at year end. Total square footage increased approximately 4.2 percent over fiscal 2004. Supply chain services sales... -

Page 19

... food business, which operates at a higher gross profit margin as a percentage of net sales than does the supply chain services business, benefits of retail merchandising execution, customer mix and the benefit of volume throughput including labor productivity improvements in supply chain services... -

Page 20

... and 2000 restructure plans was completed. The company recognized pre-tax restructure and other charges of $4.5 million, $26.4 million and $15.5 million for fiscal years 2006, 2005 and 2004 respectively. These charges reflect changes in liabilities associated with employee benefit related costs from... -

Page 21

... retail stores, distribution warehouses and other properties that are no longer being utilized in current operations. The company provides for closed property lease liabilities using a discount rate to calculate the present value of the remaining noncancellable lease payments after the closing date... -

Page 22

... health care cost trend rate would impact the accumulated post retirement benefit obligation by approximately $10 million and the service and interest cost by $0.6 million in fiscal 2007. The actuarial assumptions used by the company may differ materially from actual results due to changing market... -

Page 23

... spending to fund retail store expansion, store remodeling and technology enhancements. Fiscal 2006 activities also include capital spending related to supply chain growth initiatives. Fiscal 2005 activities also include the acquisition of Total Logistics and the proceeds from the sale of WinCo. Net... -

Page 24

the company's common stock on the New York Stock Exchange for twenty of the last thirty trading days of any fiscal quarter exceeds certain levels, at $39.75 per share for the quarter ending June 17, 2006, and rising to $113.29 per share at September 6, 2031, if the rating assigned to the debentures ... -

Page 25

...loss for minimum pension liability will be revised in future years depending upon market performance and interest rate levels. Annual cash dividends declared for fiscal 2006, 2005 and 2004, were $0.64, $0.6025 and $0.5775 per common share, respectively. The company's dividend policy will continue to... -

Page 26

... 2006. Amount of Commitment Expiration Per Period Total Amount Fiscal Fiscal Fiscal Committed 2007 2008-2009 2010-2011 Thereafter (In thousands) Contractual Obligations & Off-Balance Sheet Arrangements: Debt Operating Leases Interest on Long-Term Debt (1) Capital and Direct Financing Leases Benefit... -

Page 27

...common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal 2006 year end, there were 6,206 shareholders of record compared with 6,483 at the end of fiscal 2005. Common Stock Price Range 2006 2005 High Low High Low Dividends Per Share 2006 2005 Fiscal First Quarter Second... -

Page 28

... for the company during the fiscal year ended February 25, 2006 and did not have a material effect on the company's consolidated financial statements. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK The company is exposed to market pricing risk consisting of interest rate risk related to... -

Page 29

... to compute the fair value of the interest rate swaps. February 25, 2006 Fair Value Total Summary of Financial Instruments Aggregate payments by fiscal year 2007 2008 2009 2010 (in millions, except rates) 2011 Thereafter Notes receivable Principal receivable Average Rate receivable Debt with... -

Page 30

... the diversion of management's attention and resources The adequacy of our capital resources for future acquisitions, the expansion of existing operations or improvements to facilities Our ability to locate suitable store or distribution center sites, negotiate acceptable purchase or lease terms... -

Page 31

...'s management, including the company's chief executive officer and its chief financial officer, of the effectiveness of the design and operation of the company's disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) as of February 25, 2006, the end of the period... -

Page 32

... of this report, expresses an unqualified opinion on management's assessment and on the effectiveness of the company's internal control over financial reporting as of February 25, 2006. Changes in Internal Control Over Financial Reporting During the fiscal quarter ended February 25, 2006, there has... -

Page 33

... accounting officer or controller, or persons performing similar functions, and all other employees and non-employee directors of the company. This code of ethics is posted on the company's website (www.supervalu.com). The company intends to satisfy the disclosure requirement under Item 5.05 of Form... -

Page 34

...,428 shares of common stock at a weighted average exercise price of $27.79 per share that were assumed in connection with the merger of Richfood Holdings, Inc. into the company effective August 31, 1999. 2) 3) 4) 5) 6) 1997 Stock Plan. The Board of Directors adopted the 1997 Stock Plan on April... -

Page 35

... of restricted stock to management employees of the company or any of its subsidiaries who are not subject to the provisions of Section 16 of the Securities Exchange Act of 1934 at the time of an award. The Board amended this plan on February 24, 2001 to increase the total shares available for... -

Page 36

... Registrant's Annual Report on Form 10-K for the year ended February 28, 2004. (3)(ii) Restated Bylaws, as amended, is incorporated by reference to Exhibit (3)(ii) to the Registrant's Current Report on Form 8-K dated April 12, 2006. (4) Instruments defining the rights of security holders, including... -

Page 37

....* Resolutions of SUPERVALU INC. Board of Directors, amending the SUPERVALU INC. Restricted Stock Plan, as amended, are incorporated by reference to Exhibit 10.29 to the Registrant's Annual Report on Form 10-K for the year ended February 24, 2001.* SUPERVALU INC. 1983 Employee Stock Option Plan, as... -

Page 38

... Quarterly Report on Form 10-Q for the quarterly period (12 weeks) ended September 7, 1996.* 10.21. Second Amendment to SUPERVALU INC. Non-Qualified Supplemental Executive Retirement Plan is incorporated by reference to Exhibit (10)r. to the Registrant's Annual Report on Form 10-K for the year ended... -

Page 39

10.24. SUPERVALU INC. Non-Employee Directors Deferred Stock Plan, as amended, is incorporated by reference to Exhibit 10.24 to the Registrant's Annual Report on Form 10-K for the year ended February 22, 2003.* 10.25. Restricted Stock Unit Award Agreement for David L. Boehnen, as amended, is ... -

Page 40

...'s Quarterly Report on Form 10-Q for the quarterly period (12 weeks) ended December 4, 2004.* 10.40 Annual discretionary CEO Bonus Pool. * 10.41 Purchase and Separation Agreement by and among Albertson's, Inc., New Aloha Corporation, SUPERVALU INC. and AB Acquisition LLC, dated January 22, 2006 is... -

Page 41

...behalf by the undersigned, thereunto duly authorized. SUPERVALU INC. (Registrant) DATE: May 9, 2006 By: /s/ JEFFREY NODDLE Jeffrey Noddle Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 42

... to Section 302 of the Sarbanes-Oxley Act of 2002 I, Jeffrey Noddle, certify that: 1. I have reviewed this annual report on Form 10-K of SUPERVALU INC. for the fiscal year ended February 25, 2006; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or... -

Page 43

... 302 of the Sarbanes-Oxley Act of 2002 I, Pamela K. Knous, certify that: 1. I have reviewed this annual report on Form 10-K of SUPERVALU INC. for the fiscal year ended February 25, 2006; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state... -

Page 44

... Act of 2002, the undersigned officer of SUPERVALU INC. (the "company") certifies that the annual report on Form 10-K of the company for the fiscal year ended February 25, 2006, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and the information... -

Page 45

... Act of 2002, the undersigned officer of SUPERVALU INC. (the "company") certifies that the annual report on Form 10-K of the company for the fiscal year ended February 25, 2006, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and the information... -

Page 46

... and Schedules Page(s) Selected Financial Data: Five Year Financial and Operating Summary ...Financial Statements: Reports of Independent Registered Public Accounting Firm ...Consolidated composition of net sales and operating earnings for the fiscal years ended February 25, 2006, February... -

Page 47

... Data (a) Inventories (FIFO) (b) Working capital (b) Net property, plant and equipment Total assets Long-term debt (c) Stockholders' equity Other Statistics (a) Net earnings as a percent of net sales Return on average stockholders' equity Book value per common share Current ratio (b) Debt to capital... -

Page 48

... results of operations or financial condition. See discussion of "Risk factors" in Item 1A of this report. (b) Inventories (FIFO), working capital and current ratio are calculated after adding back the LIFO reserve. The LIFO reserve for each year is as follows: $160.0 million for fiscal 2006, $148... -

Page 49

... to above present fairly, in all material respects, the financial position of SUPERVALU INC. and subsidiaries as of February 25, 2006 and February 26, 2005, and the results of their operations and their cash flows for each of the fiscal years in the three-year period ended February 25, 2006, in... -

Page 50

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders SUPERVALU INC.: We have audited management's assessment, included in the accompanying Management's Annual Report on Internal Control Over Financial Reporting, that SUPERVALU INC. maintained effective internal... -

Page 51

...of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of SUPERVALU INC. and subsidiaries as of February 25, 2006 and ...each of the fiscal years in the three-year period ended February 25, 2006, and our report dated May 9, 2006, expressed an unqualified ... -

Page 52

...formats: extreme value stores, regional price superstores and regional supermarkets. The retail formats include results of food stores owned and results of sales to extreme value stores licensed by the company. Supply chain services operations include results of sales to affiliated food stores, mass... -

Page 53

..., except per share data) February 25, 2006 (52 weeks) February 26, 2005 (52 weeks) February 28, 2004 (53 weeks) Net sales Costs and expenses Cost of sales Selling and administrative expenses Gain on sale of WinCo Foods, Inc. Restructure and other charges Operating earnings Interest Interest... -

Page 54

SUPERVALU INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (In thousands, except per share data) February 25, 2006 ASSETS Current assets Cash and cash equivalents Receivables, less allowance for losses of $15,732 in 2006 and $22,523 in 2005 Inventories Other current assets Total current assets Long... -

Page 55

SUPERVALU INC. and Subsidiaries CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In thousands, except per share data) Capital in Common Stock Treasury Stock Excess of Shares Amount Par Value Shares Amount Accumulated Other Comprehensive Losses Retained Earnings Total BALANCES AT FEBRUARY 24, 2003 ... -

Page 56

... capital leases Dividends paid Net proceeds from the sale of common stock under option plans Payment for purchase of treasury shares Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year... -

Page 57

SUPPLEMENTAL CASH FLOW INFORMATION The company's non-cash activities were as follows: Leased asset additions and related obligations Minimum pension liability, net of deferred taxes Interest and income taxes paid: Interest paid (net of amount capitalized) Income taxes paid (net of refunds) $116,902 ... -

Page 58

... fiscal year, the company conducted its retail operations through 1,381 stores, including 862 licensed extreme value stores. Store counts are adjusted for the planned sale of Deals and corporate owned Shop 'n Save Pittsburgh. SUPERVALU also provides supply chain services, including food distribution... -

Page 59

... and amounts earned have little or no credit risk, the company generally records the net amounts as management fees earned. Cost of Sales: Cost of sales includes cost of inventory sold during the period, including purchasing and distribution costs and shipping and handling fees. Advertising expenses... -

Page 60

... on retail stores, distribution warehouses and other properties that are no longer being utilized in current operations. The company provides for closed property operating lease liabilities using a discount rate to calculate the present value of the remaining noncancellable lease payments after the... -

Page 61

...-insured for workers' compensation, health care for certain employees and general and automobile liability costs. It is the company's policy to record its self-insurance liabilities based on claims filed and an estimate of claims incurred but not yet reported, discounted at a risk free interest rate... -

Page 62

... defines the company's cost as the excess of the stock's market value at the time of the grant over the amount that the employee is required to pay. In accordance with APB Opinion No. 25, no compensation expense was recognized for options issued under the stock option plans in fiscal 2006, 2005 or... -

Page 63

...if the company had applied the fair value recognition provisions of SFAS No. 123, "Accounting for Stock-Based Compensation," as amended by SFAS No. 148, "Accounting for Stock-Based Compensation," to stock-based employee compensation: 2006 2005 2004 (In thousands, except per share data) Net earnings... -

Page 64

... based on their fair values. The company currently accounts for its share-based payments to employees under the intrinsic value method of accounting set forth in Accounting Principles Board Opinion No. 25, "Accounting for Stock Issues to Employees." Additionally, the company complies with the... -

Page 65

... and 2000 restructure plans was completed. The company recognized pre-tax restructure and other charges of $4.5 million, $26.4 million and $15.5 million for fiscal years 2006, 2005 and 2004 respectively. These charges reflect changes in liabilities associated with employee benefit related costs from... -

Page 66

... assets and the estimated fair values, which were based on the estimated market values for similar assets. SALE OF CUB FOODS-CHICAGO Concurrent with the Proposed Transaction, the company sold 26 Cub Foods stores located primarily in the Chicago area in January 2006 to the Cerberus Group for a pretax... -

Page 67

... had approximately $0.8 billion of goodwill related to retail food and $0.8 billion related to supply chain services. A summary of changes in the company's goodwill and other acquired intangible assets during fiscal 2006 and fiscal 2005 follows: February 28, AmortiOther net February 26, AmortiOther... -

Page 68

... method of accounting is used for companies and other investments in which the company has significant influence, which generally represents common stock ownership or partnership equity of at least 20 percent and not more than 50 percent. At year-end 2006, the supply chain services segment's primary... -

Page 69

... million at February 25, 2006. Notes receivable are valued based on a discounted cash flow approach applying a rate that is comparable to publicly traded debt instruments of similar credit quality. The estimated fair value of the company's long-term debt (including current maturities) was in excess... -

Page 70

... of the two. The debentures are convertible if the closing price of the company's common stock on the New York Stock Exchange for twenty of the last thirty trading days of any fiscal quarter exceeds certain levels, at $39.75 per share for the quarter ending June 17, 2006, and rising to $113.29 per... -

Page 71

... FINANCIAL STATEMENTS-(Continued) LEASES Capital and operating leases: The company leases certain retail food stores, food distribution warehouses and office facilities. Many of these leases include renewal options, and to a limited extent, include options to purchase. Amortization of assets under... -

Page 72

... company is party to a synthetic leasing program for one of its major warehouses. The lease qualifies for operating lease accounting treatment under SFAS No. 13, "Accounting for Leases." For additional information on the synthetic lease, refer to the Commitments, Contingencies and Off-Balance Sheet... -

Page 73

..., 2006, are as follows: Direct Direct Financing Financing Lease Capital Lease Receivables Obligations (In thousands) Fiscal Year 2007 2008 2009 2010 2011 Later Total minimum lease payments Less unearned income Less interest Present value of net minimum lease payments Less current portion Long-term... -

Page 74

... tax asset (liability) as of February 25, 2006 and February 26, 2005 are as follows: 2006 2005 (In thousands) Deferred tax assets: Restructure Net operating loss from acquired subsidiaries Pension liability Other health and benefit plans Other Total deferred tax assets Deferred tax liabilities... -

Page 75

... the opening and closing sale price of a share on the date of grant. The company's 1997 stock plan allows only the granting of non-qualified stock options to purchase common shares to salaried employees at fair market value determined on the same basis. In April 2002, the Board of Directors reserved... -

Page 76

SUPERVALU INC. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) The following table summarizes stock option information at year-end 2006: Options Outstanding WeightedAverage Number of Remaining Options Contractual Life WeightedAverage Exercise Price Options Exercisable ... -

Page 77

... of employee stock options and for other compensation programs utilizing the company's stock. In fiscal 2005, the company purchased approximately 0.4 million shares under the program at an average cost of $27.73 per share. In fiscal 2006, the company purchased approximately 0.9 million shares under... -

Page 78

... course of business. These contracts primarily relate to the company's commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services to the company, and agreements to indemnify officers, directors and employees in the performance of... -

Page 79

... pension benefits, the company provides health care and life insurance benefits for eligible retired employees upon meeting certain age and service requirements. The following tables set forth the changes in benefit obligations and plan assets, a reconciliation of the accrued benefit costs and total... -

Page 80

...post retirement benefit obligation by approximately $10 million and the service and interest cost by approximately $0.6 million in fiscal 2007. The company also maintains non-contributory unfunded pension plans to provide certain employees with pension benefits in excess of limits imposed by federal... -

Page 81

... rates and fiscal and monetary polices in order to assess the capital market assumptions. The company reviews and selects the discount rate to be used in connection with its postretirement obligations annually. In determining the discount rate, the company uses the yield on corporate bonds (rated... -

Page 82

... such as investment returns and benefit levels. SHAREHOLDER RIGHTS PLAN On April 24, 2000, the company announced that the Board of Directors adopted a Shareholder Rights Plan under which one preferred stock purchase right is distributed for each outstanding share of common stock. The F-37 -

Page 83

... years. The rights become exercisable, with certain exceptions, after a person or group acquires beneficial ownership of 15 percent or more of the outstanding voting stock of the company. SUBSEQUENT EVENTS On March 13, 2006, the pre-merger waiting period for the Proposed Transaction with Albertson... -

Page 84

... (16 wks) Fiscal Year Ended February 25, 2006 Second Third Fourth (12 wks) (12 wks) (12 wks) Year (52 wks) Net sales Gross profit Net earnings Net earnings per common share-basic (a) Net earnings per common share-diluted (a) Dividends declared per common share Weighted average shares-basic Weighted... -

Page 85

SUPERVALU INC. and Subsidiaries SCHEDULE II-Valuation and Qualifying Accounts (In thousands) COLUMN A COLUMN B Balance at beginning of year COLUMN C COLUMN D COLUMN E Balance at end of year Description Additions Deductions Allowance for doubtful accounts: Year ended: February 25, 2006 February ...