3M 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

Dividends on shares held by the ESOP are paid to the ESOP trust and, together with Company contributions, are

used by the ESOP to repay principal and interest on the outstanding ESOP debt. The tax benefit related to dividends

paid on unallocated shares was charged directly to equity and totaled approximately $2 million in 2008, $3 million in

2007, and $3 million in 2006. Over the life of the ESOP debt, shares are released for allocation to participants based

on the ratio of the current year’s debt service to the remaining debt service prior to the current payment.

The ESOP has been the primary funding source for the Company’s employee savings plans. As permitted by AICPA

Statement of Position 93-6, “Employers’ Accounting for Employee Stock Ownership Plans,” the Company has

elected to continue its practices, which are based on Statement of Position 76-3, “Accounting Practices for Certain

Employee Stock Ownership Plans” and subsequent consensus of the EITF of the FASB. Accordingly, the debt of the

ESOP is recorded as debt, and shares pledged as collateral are reported as unearned compensation in the

Consolidated Balance Sheet and Consolidated Statement of Changes in Stockholders’ Equity and Comprehensive

Income. Unearned compensation is reduced symmetrically as the ESOP makes principal payments on the debt.

Expenses related to the ESOP include total debt service on the notes, less dividends. The Company contributes

treasury shares, accounted for at fair value, to employee savings plans to cover obligations not funded by the ESOP

(reported as an employee benefit expense).

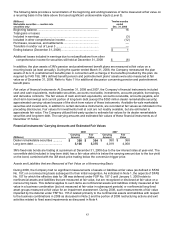

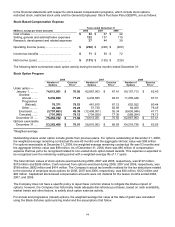

Employee Savings and Stock Ownership Plans

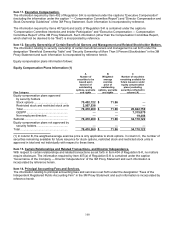

(Millions) 2008 2007 2006

Dividends on shares held by the ESOP................... $33

$ 37 $ 39

Company contributions to the ESOP ....................... 14 10 9

Interest incurred on ESOP notes ............................. 3

5 8

Amounts reported as an employee benefit expense:

Expenses related to ESOP debt service .............. 9

5 4

Expenses related to treasury shares.................... 3

34 36

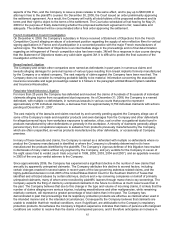

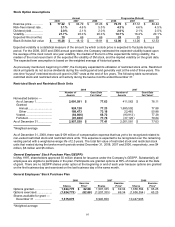

ESOP Debt Shares

2008 2007 2006

Allocated............................................. 14,240,026 14,039,070 15,956,530

Committed to be released .................. 27,201 278,125 286,620

Unreleased ......................................... 1,333,692 2,457,641 3,831,425

Total ESOP debt shares .................... 15,600,919 16,774,836 20,074,575

NOTE 16. Stock-Based Compensation

In May 2008, shareholders approved 35 million shares for issuance under the “3M 2008 Long-Term Incentive Plan”,

which replaced and succeeded the 2005 Management Stock Ownership Program (MSOP), the 3M Performance Unit

Plan, and the 1992 Directors Stock Ownership Program. Shares under this plan may be issued in the form of

Incentive Stock Options, Nonqualified Stock Options, Progressive Stock Options, Stock Appreciation Rights,

Restricted Stock, Restricted Stock Units, Other Stock Awards, and Performance Units and Performance Shares.

Awards denominated in shares of common stock other than options and Stock Appreciation Rights, per the 2008

Plan, will be counted against the 35 million share limit as 3.38 shares for every one share covered by such award.

The remaining total shares available for grant under the 2008 Long Term Incentive Plan Program are 26,842,759 as

of December 31, 2008. In 2008 and prior, the Company issued options to eligible employees annually in May using

the closing stock price on the grant date, which was the date of the Annual Stockholders’ Meeting. In addition to

these annual grants, the Company makes other minor grants of stock options, restricted stock units and other stock-

based grants. The Company issues cash settled Restricted Stock Units and Stock Appreciation Rights in certain

countries. These grants do not result in the issuance of Common Stock and are considered immaterial by the

Company. There were approximately 14,372 participants with outstanding options, restricted stock, or restricted

stock units at December 31, 2008.

Effective with the May 2005 Management Stock Ownership Program annual grant, the Company changed its vesting

period from one to three years with the expiration date remaining at 10 years from date of grant. Beginning in 2007,

the Company reduced the number of traditional stock options granted under the MSOP plan by reducing the number

of employees eligible to receive annual grants and by shifting a portion of the annual grant away from traditional

stock options primarily to restricted stock units. However, associated with the reduction in the number of eligible

employees, the Company provided a one-time “buyout” grant of restricted stock units to the impacted employees,

which resulted in increased stock-based compensation expense in 2007. The income tax benefits shown in the

following table can fluctuate by period due to the amount of Incentive Stock Options (ISO) exercised since the

Company receives the ISO tax benefit upon exercise. The Company last granted ISO in 2002. Amounts recognized