3M 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

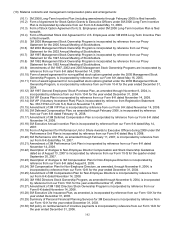

97

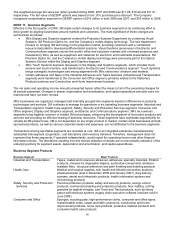

Business Segment Major Products

Display and Graphics

Optical films solutions for electronic displays, reflective sheeting for transportation

safety, commercial graphics systems, and projection systems, including mobile

display technology and visual systems

Electro and Communications

Packaging and interconnection devices, insulating and splicing solutions for the

electronics, telecommunications and electrical industries, and touch screens and

touch monitors

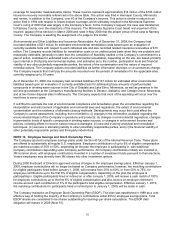

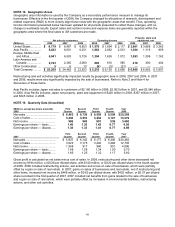

Business Segment Information

Net Sales Operating Income

(Millions) 2008 2007 2006 2008 2007 2006

Industrial and Transportation $ 7,818

$ 7,266 $ 6,632 $ 1,477 $ 1,497 $ 1,338

Health Care ......................... 4,293

3,968 4,011 1,173 1,882 1,845

Safety, Security and

Protection Services.......... 3,642

3,070 2,663 736 611 549

Consumer and Office .......... 3,448

3,411 3,172 663 692 633

Display and Graphics .......... 3,255

3,904 3,747 580 1,163 1,045

Electro and Communications 2,791

2,763 2,654 531 492 410

Corporate and Unallocated . 22

80 44 58 (144 ) (124 )

Total Company .................... $ 25,269

$ 24,462 $ 22,923 $ 5,218 $ 6,193 $ 5,696

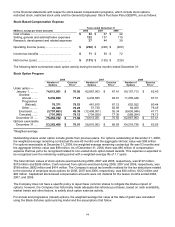

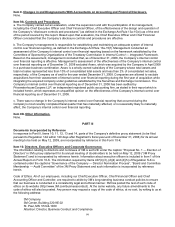

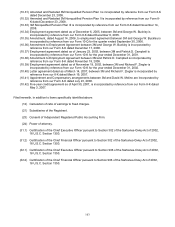

Assets Depreciation & Amortization Capital Expenditures

(Millions) 2008 2007 2006 2008 2007 2006 2008 2007 2006

Industrial and

Transportation.............. $ 6,202

$ 5,872 $ 5,180 $ 312 $ 294 $ 287

$ 395

$ 396 $ 284

Health Care ..................... 3,096

2,909 2,477 161 138 162

210

213 159

Safety, Security and

Protection Services...... 3,326

2,344 2,061

170 161 120 180

205 151

Consumer and Office ...... 1,786

1,720 1,577 86 82 77

107

101 103

Display and Graphics ...... 3,479

3,199 3,035 243 222 232

379

341 323

Electro and

Communications .......... 2,186

2,063 2,003 141 146 173

177

136 117

Corporate and

Unallocated.................. 5,472

6,587 4,961 40 29 28

23

30 31

Total Company ................ $ 25,547

$ 24,694 $ 21,294 $ 1,153 $ 1,072 $ 1,079

$ 1,471

$ 1,422 $ 1,168

Segment assets for the operating business segments (excluding Corporate and Unallocated) primarily include

accounts receivable; inventory; property, plant and equipment — net; goodwill and intangible assets; and other

miscellaneous assets. Assets included in Corporate and Unallocated principally are cash, cash equivalents and

marketable securities; insurance receivables; deferred income taxes; certain investments and other assets, including

prepaid pension assets. Corporate and unallocated assets can change from year to year due to changes in cash,

cash equivalents and marketable securities, changes in prepaid pension benefits, and changes in other unallocated

asset categories. For management reporting purposes, corporate goodwill (which at December 31, 2008, totaled

$487 million) is not allocated to the six operating business segments. In Note 3, corporate goodwill has been

allocated to the respective market segments as required by SFAS No. 142 for impairment testing.

Corporate and Unallocated operating income includes a variety of miscellaneous items, such as corporate investment

gains and losses, certain derivative gains and losses, insurance-related gains and losses, certain litigation and

environmental expenses, corporate restructuring charges and certain under- or over-absorbed costs (e.g. pension)

that the Company may choose not to allocate directly to its business segments. Because this category includes a

variety of miscellaneous items, it is subject to fluctuation on a quarterly and annual basis.

The most significant items impacting 2008 results were restructuring actions and exit activities. The most significant

items impacting both 2007 and 2006 results are the net gain on sale of the pharmaceuticals business (within the

Health Care segment) and restructuring and other actions. Refer to Note 2 for discussion of divestitures and Note 4

for discussion of restructuring actions and exit activities.