3M 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

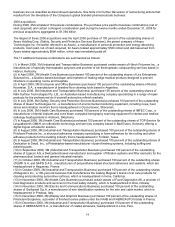

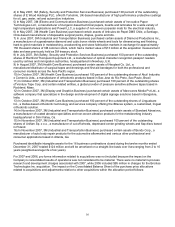

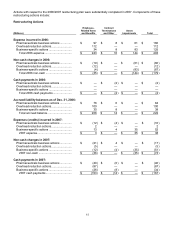

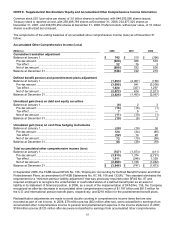

62

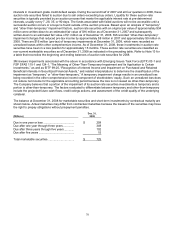

Employee- Contract

Related Items Terminations Asset

(Millions) and Benefits and Other Impairments Total

Accrued liability balances as of Dec. 31, 2007:

Pharmaceuticals business actions ............... $ 5 $ — $ — $ 5

Overhead reduction actions.......................... 10 — — 10

Business-specific actions ............................. 5 — — 5

Total accrued liability balance................... $ 20 $ — $ — $ 20

Cash payments in 2008:

Pharmaceuticals business actions ............... $ (5 ) $ — $ — $ (5 )

Overhead reduction actions.......................... (10 ) — — (10 )

Business-specific actions ............................. (4 ) — — (4 )

2008 cash payments................................. $ (19 ) $ — $ — $ (19 )

Accrued liability balances as of Dec. 31, 2008:

Pharmaceuticals business actions ............... $ — $ — $ — $ —

Overhead reduction actions.......................... — — — —

Business-specific actions ............................. 1 — — 1

Total accrued liability balance................... $ 1 $ — $ — $ 1

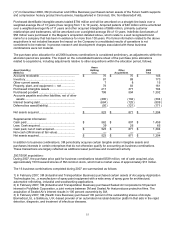

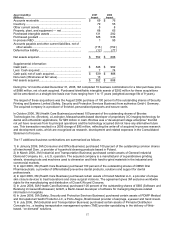

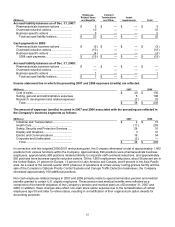

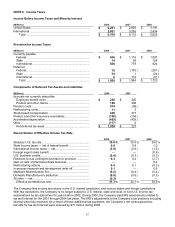

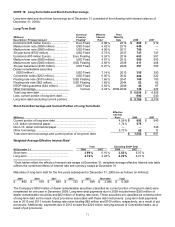

Income statement line in which the preceding 2007 and 2006 expenses (credits) are reflected:

(Millions) 2007 2006

Cost of sales ................................................. $ 40 $ 130

Selling, general and administrative expenses 5 198

Research, development and related expenses (7 ) 75

Total .......................................................... $ 38 $ 403

The amount of expenses (credits) incurred in 2007 and 2006 associated with the preceding are reflected in

the Company’s business segments as follows:

(Millions) 2007 2006

Industrial and Transportation........................ $ 2 $ 15

Health Care................................................... (11 ) 293

Safety, Security and Protection Services ..... 28 10

Display and Graphics ................................... 3 31

Electro and Communications........................ 18 54

Corporate and Unallocated........................... (2 ) —

Total .......................................................... $ 38 $ 403

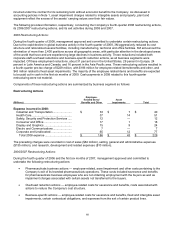

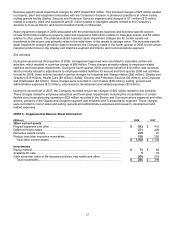

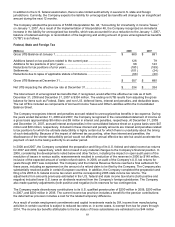

In connection with this targeted 2006/2007 restructuring plan, the Company eliminated a total of approximately 1,900

positions from various functions within the Company. Approximately 390 positions were pharmaceuticals business

employees, approximately 960 positions related primarily to corporate staff overhead reductions, and approximately

550 positions were business-specific reduction actions. Of the 1,900 employment reductions, about 58 percent are in

the United States, 21 percent in Europe, 12 percent in Latin America and Canada, and 9 percent in the Asia Pacific

area. As a result of the second-quarter 2007 phaseout of operations at a New Jersey roofing granule facility and the

sale of the Company’s Opticom Priority Control Systems and Canoga Traffic Detection businesses, the Company

eliminated approximately 100 additional positions.

Non-cash employee-related changes in 2007 and 2006 primarily relate to special termination pension and medical

benefits granted to certain U.S. eligible employees. These pension and medical benefits were reflected as a

component of the benefit obligation of the Company’s pension and medical plans as of December 31, 2007 and

2006. In addition, these changes also reflect non-cash stock option expense due to the reclassification of certain

employees age 50 and older to retiree status, resulting in a modification of their original stock option awards for

accounting purposes.