3M 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

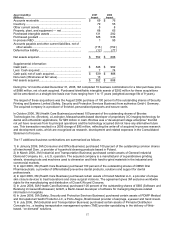

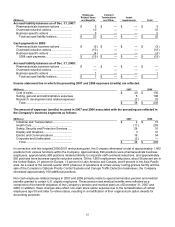

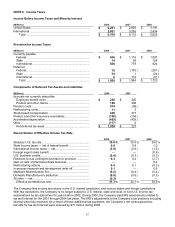

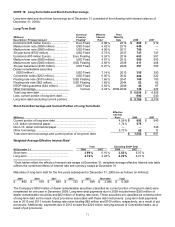

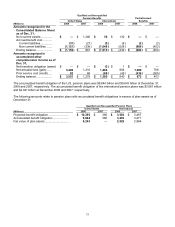

NOTE 8. Income Taxes

Income Before Income Taxes and Minority Interest

(Millions) 2008 2007 2006

United States.......................................................................... $ 2,251 $ 2,820 $ 3,191

International............................................................................ 2,857 3,295 2,434

Total ................................................................................ $ 5,108 $ 6,115 $ 5,625

Provision for Income Taxes

(Millions) 2008 2007 2006

Currently payable

Federal................................................................................ $ 636 $ 1,116 $ 1,087

State ................................................................................... 14 58 128

International ........................................................................ 820 779 824

Deferred

Federal................................................................................ 78 (105 ) (261 )

State ................................................................................... 34 1 (24 )

International ........................................................................ 6 115 (31 )

Total ................................................................................ $ 1,588 $ 1,964 $ 1,723

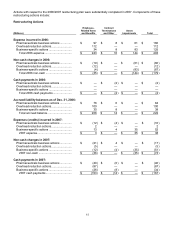

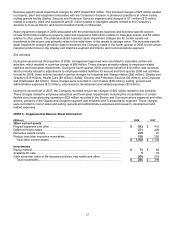

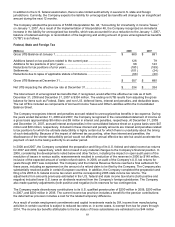

Components of Deferred Tax Assets and Liabilities

(Millions) 2008 2007

Accruals not currently deductible

Employee benefit costs ...................................................... $ 230 $ 240

Product and other claims.................................................... 198 258

Pension costs ......................................................................... 914 (99 )

Restructuring costs................................................................. 11 2

Stock-based compensation.................................................... 425 377

Product and other insurance receivables............................... (100 ) (154 )

Accelerated depreciation........................................................ (463 ) (403 )

Other ...................................................................................... (177 ) 6

Net deferred tax asset ........................................................ $ 1,038 $ 227

Reconciliation of Effective Income Tax Rate

2008 2007 2006

Statutory U.S. tax rate............................................................ 35.0 % 35.0 % 35.0 %

State income taxes — net of federal benefit .......................... 0.9 0.9 1.0

International income taxes — net........................................... (3.9 ) (2.8 ) (1.5 )

Foreign export sales benefit................................................... — — (0.9 )

U.S. business credits.............................................................. (0.4 ) (0.3 ) (0.3 )

Reserves for tax contingencies/return to provision ................ 0.3 0.4 (2.7 )

Gain on sale of pharmaceuticals business............................. — — 0.4

Restructuring actions.............................................................. 0.4 0.1 (0.3 )

In-process research and development write-off..................... 0.1 — 0.6

Medicare Modernization Act................................................... (0.2 ) (0.4 ) (0.4 )

Domestic Manufacturer’s deduction....................................... (0.8 ) (0.8 ) (0.3 )

All other — net........................................................................ (0.3 ) — —

Effective worldwide tax rate................................................ 31.1 % 32.1 % 30.6 %

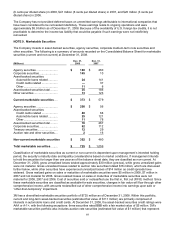

The Company files income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions.

With few exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax

examinations by tax authorities for years before 2002. During 2008, the Company paid IRS assessments related to

tax and interest for the 2001 through 2004 tax years. The IRS’s adjustments to the Company’s tax positions including

interest were fully reserved. As a result of these additional tax payments, the Company’s net unrecognized tax

benefits for tax and interest were reduced by $71 million during 2008.