3M 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

8) In July 2006, 3M (Electro and Communications Business) purchased certain assets of SCC Products Inc. and JJ

Converting LLC, both based in Sanford, N.C. SCC Products Inc. is a provider of flexible static control packaging and

workstation products for electronic devices. JJ Converting LLC is a producer of films used to make static control

bags.

9) In August 2006, 3M (Display and Graphics Business) purchased 100 percent of the outstanding shares of Archon

Technologies Inc., a Denver, Colorado-based provider of enterprise software solutions for motor vehicle agencies.

10) In August 2006, 3M (Safety, Security and Protection Services Business) purchased 100 percent of the

outstanding shares of Aerion Technologies, a Denver, Colorado-based maker of safety products, including heat

stress monitors, thermal cameras and carbon monoxide detectors.

11) In September 2006, 3M (Electro and Communications Business) purchased 100 percent of the outstanding

shares of Credence Technologies Inc., a Soquel, California-based provider of instruments and high-end monitoring

equipment for electrostatic discharge control and electromagnetic compliance.

12) In October 2006, 3M (Consumer and Office Business) purchased certain assets of Nylonge Corp., a global

provider of household cleaning products, including cellulose sponges, scrub sponges and household wipes.

13) In October 2006, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding shares

of NorthStar Chemicals, Inc., a Cartersville, Georgia-based adhesive manufacturer.

14) In November 2006, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding

shares of Global Beverage Group Inc., a Canadian-based provider of delivery management software solutions for the

direct-store-delivery of consumer packaged goods.

15) In November 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Biotrace

International PLC, a Bridgend, UK-based manufacturer and supplier of industrial microbiology products used in food

processing safety, health care, industrial hygiene and defense applications.

16) In December 2006, 3M (Electro and Communications Business) purchased certain assets of Mahindra

Engineering and Chemical Products LTD, an India-based manufacturer of cable jointing kits and accessories.

17) In December 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of SoftMed

Systems Inc., a Maryland-based provider of health information management software and services that improve the

workflow and efficiency of health care organizations.

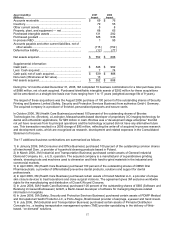

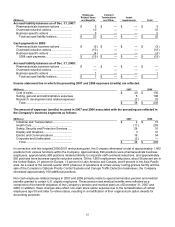

The 2006 impact on the Consolidated Balance Sheet of the purchase price allocations related to the 2006

acquisitions and adjustments relative to other acquisitions within the allocation period were provided in the preceding

table.

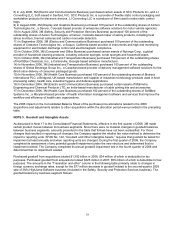

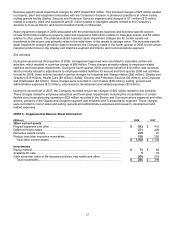

NOTE 3. Goodwill and Intangible Assets

As discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2008, 3M made

certain product moves between its business segments. Since there were no material changes in goodwill balances

between business segments, amounts presented in the table that follows have not been reclassified. For those

changes that resulted in reporting unit changes, the Company applied the relative fair value method to determine the

impact to reporting units. SFAS No. 142, “Goodwill and Other Intangible Assets,” requires that goodwill be tested for

impairment at least annually and when reporting units are changed. During the first quarter of 2008, the Company

completed its assessment of any potential goodwill impairment under the new structure and determined that no

impairment existed. The Company completed its annual goodwill impairment test in the fourth quarter of 2008 and

determined that no impairment existed.

Purchased goodwill from acquisitions totaled $1.392 billion in 2008, $34 million of which is deductible for tax

purposes. Purchased goodwill from acquisitions totaled $326 million in 2007, $55 million of which is deductible for tax

purposes. The amounts in the “Translation and other” column in the following table primarily relate to changes in

foreign currency exchange rates, except for the $77 million decrease in goodwill related to the second-quarter 2008

sale of 3M’s HighJump Software business (included in the Safety, Security and Protection Services business). The

goodwill balance by business segment follows: