3M 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

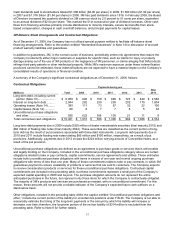

46

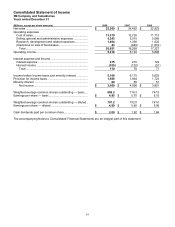

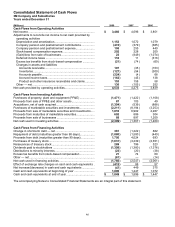

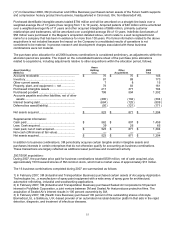

Consolidated Statement of Cash Flows

3M Company and Subsidiaries

Years ended December 31

(Millions) 2008 2007 2006

Cash Flows from Operating Activities

Net income .................................................................................... $ 3,460 $ 4,096 $ 3,851

Adjustments to reconcile net income to net cash provided by

operating activities

Depreciation and amortization................................................... 1,153 1,072 1,079

Company pension and postretirement contributions................. (474 ) (379 ) (385 )

Company pension and postretirement expense........................ 105 255 440

Stock-based compensation expense......................................... 202 228 200

(Gain)/loss from sale of businesses .......................................... 23 (849 ) (1,074 )

Deferred income taxes .............................................................. 118 11 (316 )

Excess tax benefits from stock-based compensation ............... (21 ) (74 ) (60 )

Changes in assets and liabilities

Accounts receivable............................................................... 197 (35 ) (103 )

Inventories.............................................................................. (127 ) (54 ) (309 )

Accounts payable................................................................... (224 ) (4 ) 68

Accrued income taxes............................................................ (162 ) (45 ) 138

Product and other insurance receivables and claims ............ 153 158 58

Other — net ............................................................................... 130 (105 ) 252

Net cash provided by operating activities...................................... 4,533 4,275 3,839

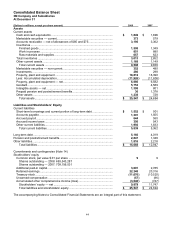

Cash Flows from Investing Activities

Purchases of property, plant and equipment (PP&E) ................... (1,471 ) (1,422 ) (1,168 )

Proceeds from sale of PP&E and other assets............................. 87 103 49

Acquisitions, net of cash acquired................................................. (1,394 ) (539 ) (888 )

Purchases of marketable securities and investments................... (2,211 ) (8,194 ) (3,253 )

Proceeds from sale of marketable securities and investments..... 1,810 6,902 2,287

Proceeds from maturities of marketable securities ....................... 692 886 304

Proceeds from sale of businesses ................................................ 88 897 1,209

Net cash used in investing activities ............................................. (2,399 ) (1,367 ) (1,460 )

Cash Flows from Financing Activities

Change in short-term debt — net.................................................. 361 (1,222 ) 882

Repayment of debt (maturities greater than 90 days)................... (1,080 ) (1,580 ) (440 )

Proceeds from debt (maturities greater than 90 days).................. 1,756 4,024 693

Purchases of treasury stock.......................................................... (1,631 ) (3,239 ) (2,351 )

Reissuances of treasury stock ...................................................... 289 796 523

Dividends paid to stockholders ..................................................... (1,398 ) (1,380 ) (1,376 )

Distributions to minority interests .................................................. (23 ) (20 ) (38 )

Excess tax benefits from stock-based compensation ................... 21 74 60

Other — net................................................................................... (61 ) — (14 )

Net cash used in financing activities ............................................. (1,766 ) (2,547 ) (2,061 )

Effect of exchange rate changes on cash and cash equivalents . (415 ) 88 57

Net increase/(decrease) in cash and cash equivalents ................ (47 ) 449 375

Cash and cash equivalents at beginning of year .......................... 1,896 1,447 1,072

Cash and cash equivalents at end of year.................................... $ 1,849 $ 1,896 $ 1,447

The accompanying Notes to Consolidated Financial Statements are an integral part of this statement.