3M 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

performance benefited significantly from the long duration instruments. The average annual actual return on the plan

assets over the past 10 and 25 years has been 5.7% and 10.9%, respectively.

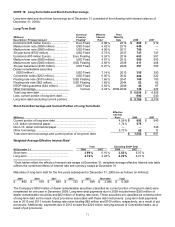

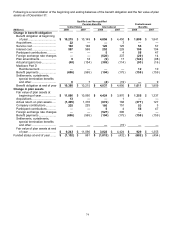

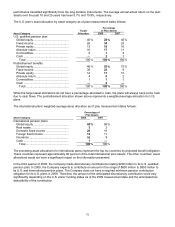

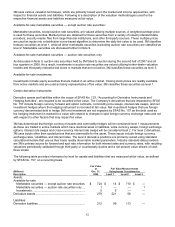

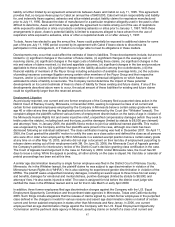

The U.S. plan’s asset allocation by asset category as of plan measurement dates follows:

Target

Percentage

of Plan Assets

Asset Category Allocation 2008 2007

U.S. qualified pension plan

Global equity............................................. 40 % 28 % 45 %

Fixed income ............................................ 26 34 23

Private equity ............................................ 13 18 16

Absolute return ......................................... 16 17 11

Commodities............................................. 5 1

4

Cash ......................................................... — 2

1

Total ...................................................... 100 % 100 % 100 %

Postretirement benefits

Global equity............................................. 46 % 53 % 75 %

Fixed income ............................................ 35 23 9

Private equity ............................................ 14 17 13

Absolute return ......................................... 4 4

2

Commodities............................................. 1 1

1

Cash ......................................................... — 2 —

Total ...................................................... 100 % 100 % 100 %

While the target asset allocations do not have a percentage allocated to cash, the plans will always have some cash

due to cash flows. The postretirement allocation shown above represents a weighted-average allocation for U.S.

plans.

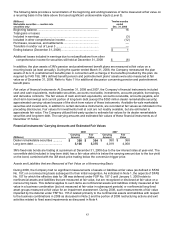

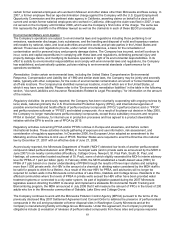

The international plans’ weighted-average asset allocation as of plan measurement dates follows:

Percentage of

Plan Assets

Asset Category 2008 2007

International pension plans

Global equity............................................. 45 % 58 %

Real estate................................................ 3

3

Domestic fixed income ............................. 20 19

Foreign fixed income ................................ 15 11

Insurance .................................................. 16 9

Cash ......................................................... 1 —

Total ...................................................... 100 % 100 %

The preceding asset allocations for international plans represent the top six countries by projected benefit obligation.

These countries represent approximately 90 percent of the total international plan assets. The other countries’ asset

allocations would not have a significant impact on the information presented.

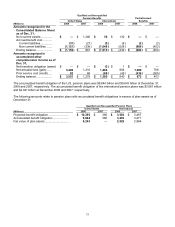

In the third quarter of 2008, the Company made discretionary contributions totaling $200 million to its U.S. qualified

pension plan. In 2009, the Company expects to contribute an amount in the range of $600 million to $850 million to

its U.S. and international pension plans. The Company does not have a required minimum pension contribution

obligation for its U.S. plans in 2009. Therefore, the amount of the anticipated discretionary contribution could vary

significantly depending on the U.S. plans’ funding status as of the 2009 measurement date and the anticipated tax

deductibility of the contribution.