3M 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

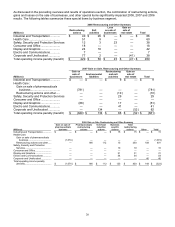

OVERVIEW

3M is a diversified global manufacturer, technology innovator and marketer of a wide variety of products. As

discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2008, 3M made certain

product moves between its business segments. The financial information presented herein reflects the impact of

these changes for all periods presented. 3M manages its operations in six operating business segments: Industrial

and Transportation; Health Care; Safety, Security and Protection Services; Consumer and Office; Display and

Graphics; and Electro and Communications.

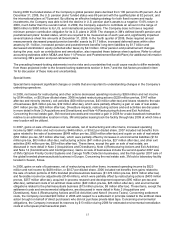

3M had record sales in 2008 despite a dramatic fourth-quarter 2008 economic downturn. 3M is responding to this

lower demand with aggressive cost and cash management, along with tighter operational discipline. 3M expects to

manage through these worldwide market challenges and is positioning itself to benefit when growth returns. 3M

streamlined its operations through 2008 and will continue to optimize to protect against the downside throughout

2009. In the fourth quarter of 2008 alone, 3M announced reductions of over 2,400 full-time positions worldwide,

which brought total year reductions to approximately 3,500. These job eliminations spanned all sectors and all

geographies, but were particularly focused on those developed economies experiencing the most sales pressure. In

addition, 3M has furloughed factory workers until production volumes return to more normal levels and contract

workers are also being reduced to only those considered essential. These 2008 actions in total are expected to save

the Company $250 to $300 million in 2009. 3M also decided to defer merit pay increases in 2009 except in those

cases where local laws prohibit it, with estimated cost-avoidance of approximately $100 million in 2009. In addition,

3M has amended its practice on banked vacation — effectively phasing it out — which will reduce expenses by an

estimated $100 million in both 2009 and 2010.

While this market is difficult to predict, in 2009 for planning purposes, 3M is assuming year-on-year declines in

organic sales volume, negative foreign currency impacts on sales, operating margin declines, and earnings per share

declines. 3M will work to conserve cash by reducing capital expenditures by more than 30 percent in 2009 and by

focusing on reducing working capital. 3M has halted stock repurchases until the credit market offers more visibility.

The strength of 3M’s customer focused diversified business and technology platforms, unparalled geographic reach,

and relentless attention to operational excellence, along with 3M’s balance sheet strength, provide a strong

foundation for stability and consistency in an uncertain global economy.

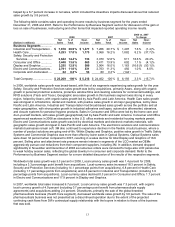

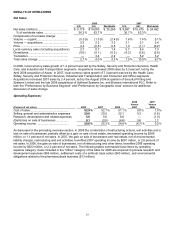

For the three months ended December 31, 2008, sales decreased 11.2 percent compared to the same period last

year, due to an increasingly challenging global economy. Local currency sales (which include volume, selling price

and acquisition impacts, but exclude divestiture and translation impacts) increased in Safety, Security and Protection

Services and in Health Care. Sales in local currencies for the other four business segments dropped during the fourth

quarter. Fourth quarter 2008 net income was $536 million, or $0.77 per diluted share, compared to $851 million, or

$1.17 per diluted share in the fourth quarter of 2007. In response to difficult economic conditions, in the fourth-quarter

of 2008, 3M took actions which resulted in net pre-tax charges of $219 million for restructuring actions and exit

activities, which reduced net income by $140 million, or $0.20 per diluted share, as 3M aggressively balanced its cost

structure to a slower growth environment. The fourth quarter of 2007 included net pre-tax charges of $20 million

related to restructuring, exit activities and a loss on sale of businesses, which reduced net income by $12 million, or

$0.02 per diluted share. Refer to the “Special Items” summary at the end of this overview section for more detail on

these items that impacted results.

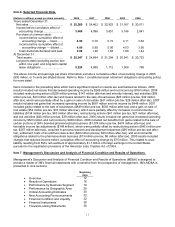

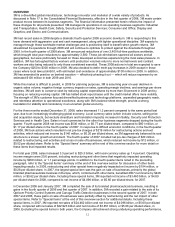

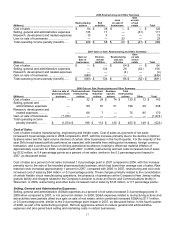

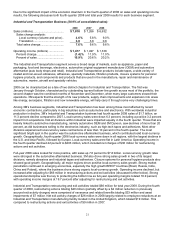

For total year 2008, sales increased 3.3 percent to $25.3 billion, with local-currency sales up 1.4 percent. Operating

income margins were 20.6 percent, including restructuring and other items that negatively impacted operating

income by $269 million, or 1.1 percentage points. In addition to the fourth quarter items noted in the preceding

paragraph, refer to the “Special Items” summary at the end of this overview section for discussion of other items

impacting results. In 2008, restructuring and other special items negatively impacted net income by $194 million, or

$0.28 per diluted share. In 2007, the largest special item was the gain on sale of businesses, primarily the global

branded pharmaceuticals business in Europe, which, combined with other items, benefited 2007 net income by $448

million, or $0.62 per diluted share. Including these special items, 3M reported net income of $3.460 billion, or $4.89

per diluted share for 2008, compared to net income of $4.096 billion, or $5.60 per diluted share, for 2007.

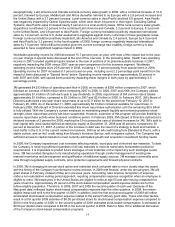

In December 2006 and January 2007, 3M completed the sale of its branded pharmaceuticals business, resulting in

gains in the fourth quarter of 2006 and first quarter of 2007. In addition, 3M recorded a gain related to the sale of its

Opticom Priority Control Systems and Canoga Traffic Detection businesses in the second quarter of 2007. In both

2007 and 2006, these gains on sale of businesses were partially offset by restructuring and the net impact of other

special items. Refer to “Special Items” at the end of this overview section for additional details. Including these

special items, in 2007, 3M reported net sales of $24.462 billion and net income of $4.096 billion, or $5.60 per diluted

share, compared with net sales of $22.923 billion and net income of $3.851 billion, or $5.06 per diluted share, in

2006. Excluding the special items in both years, the Company still achieved strong underlying operating performance,