3M 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

incurred under the contract for its remaining term without economic benefit to the Company. As discussed in

accounting policies in Note 1, asset impairment charges related to intangible assets and property, plant and

equipment reflect the excess of the assets’ carrying values over their fair values.

The following provides information, respectively, concerning the Company’s fourth-quarter 2008 restructuring actions,

its 2006/2007 restructuring actions, and its exit activities during 2008 and 2007.

2008 Restructuring Actions:

During the fourth quarter of 2008, management approved and committed to undertake certain restructuring actions.

Due to the rapid decline in global business activity in the fourth quarter of 2008, 3M aggressively reduced its cost

structure and rationalized several facilities, including manufacturing, technical and office facilities. 3M announced the

elimination of more than 2,400 positions across all geographic areas, with particular attention in the developed areas

of the world that have and are experiencing large declines in business activity. These reductions included both

corporate staff overhead reductions and business-specific reduction actions, as all business segments were

impacted. Of these employment reductions, about 31 percent are in the United States, 29 percent in Europe, 24

percent in Latin America and Canada, and 16 percent in the Asia Pacific area. These restructuring actions resulted in

a fourth-quarter pre-tax charge of $229 million, with $186 million for employee-related items/benefits and other, and

$43 million related to fixed asset impairments. The majority of the employee related items and benefits are expected

to be paid out in cash in the first six months of 2009. Cash payments in 2008 related to this fourth-quarter

restructuring were not material.

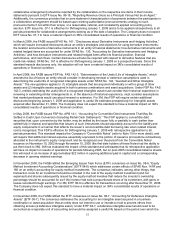

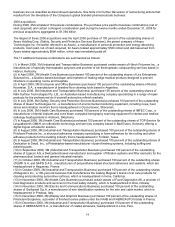

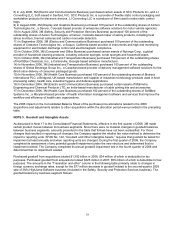

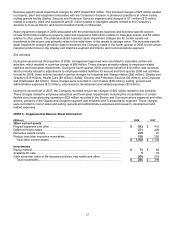

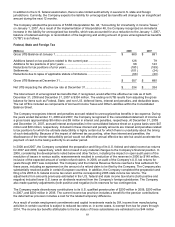

Components of these restructuring actions are summarized by business segment as follows:

Restructuring Actions

Employee-

Related Items/ Asset

(Millions) Benefits and Other Impairments Total

Expense incurred in 2008:

Industrial and Transportation........................ $ 33 $ 7 $ 40

Health Care................................................... 37 14 51

Safety, Security and Protection Services ..... 12 — 12

Consumer and Office.................................... 17 1 18

Display and Graphics ................................... 15 9 24

Electro and Communications........................ 7 — 7

Corporate and Unallocated........................... 65 12 77

Total 2008 expense .................................. $ 186 $ 43 $ 229

The preceding charges were recorded in cost of sales ($84 million), selling, general and administrative expenses

($135 million), and research, development and related expenses ($10 million).

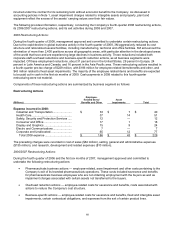

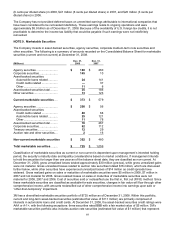

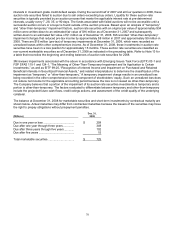

2006/2007 Restructuring Actions:

During the fourth quarter of 2006 and the first six months of 2007, management approved and committed to

undertake the following restructuring actions:

• Pharmaceuticals business actions — employee-related, asset impairment and other costs pertaining to the

Company’s exit of its branded pharmaceuticals operations. These costs included severance and benefits

for pharmaceuticals business employees who are not obtaining employment with the buyers as well as

impairment charges associated with certain assets not transferred to the buyers.

• Overhead reduction actions — employee-related costs for severance and benefits, costs associated with

actions to reduce the Company’s cost structure.

• Business-specific actions — employee-related costs for severance and benefits, fixed and intangible asset

impairments, certain contractual obligations, and expenses from the exit of certain product lines.