eTrade 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197

|

|

Table of Contents

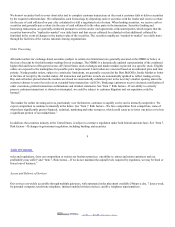

Maturity of Loan Portfolio. The following table shows, as of December 31, 2001, the dollar amount of loans maturing in our portfolio

in the time periods indicated. This information includes scheduled principal repayments, based on the loans’ contractual maturities.

We report demand loans, loans with no stated repayment schedule and no stated maturity, and overdrafts as due within one year. The

table below does not include any estimate of prepayments. Prepayments may significantly shorten the average life of a loan and may

cause our actual repayment experience to differ from that shown below.

DueinOne

YearorLess

Due in One toFiveYears Due After Five Years Total

(in thousands)

Real estate loans:

One- to four-family fixed-rate $ 8,465 $ 35,627 $ 3,628,420 $ 3,672,512

One- to four-family

adjustable-rate

486 3,075 2,642,391 2,645,952

Multi-family — — 183 183

Commercial — 9 1,972 1,981

Mixed-use 87 39 509 635

Consumer and other loans:

Home equity lines of credit and

second mortgage

loans

— 70 22,989 23,059

Automobiles and recreational

vehicles loans

13,253 1,243,345 378,452 1,635,050

Other 50 12,187 — 12,237

Total $ 22,341 $ 1,294,352 $ 6,674,916 $ 7,991,609

The following table shows, as of December 31, 2001, the dollar amount of our loans that mature after December 31, 2001. We have

allocated these loans between those with fixed interest rates and those with adjustable interest rates.

Fixed Rates Adjustable Rates Total

(in thousands)

Real estate loans:

One- to four-family $ 3,672,512 $ 2,645,952 $ 6,318,464

Multi-family — 183 183

Commercial 1,130 851 1,981

Mixed-use 237 398 635

Consumer and other loans:

Home equity lines of credit and second mortgage

loans

19,137 3,922 23,059

Automobiles and recreational vehicles loans 1,625,396 9,654 1,635,050

Other — 12,237 12,237

Total $ 5,318,412 $ 2,673,197 $ 7,991,609

2002. EDGAR Online, Inc.